Rain in the south and bright sun in the north for the traditional start of the grain growing season for WA

Crops are up and away in the southern grain growing regions of Western Australia following several decent falls of rain in April. However, the northern half of the state is mostly dry with little or no crops up and no subsoil moisture available to risk sowing on the light rainfall events that have occurred.

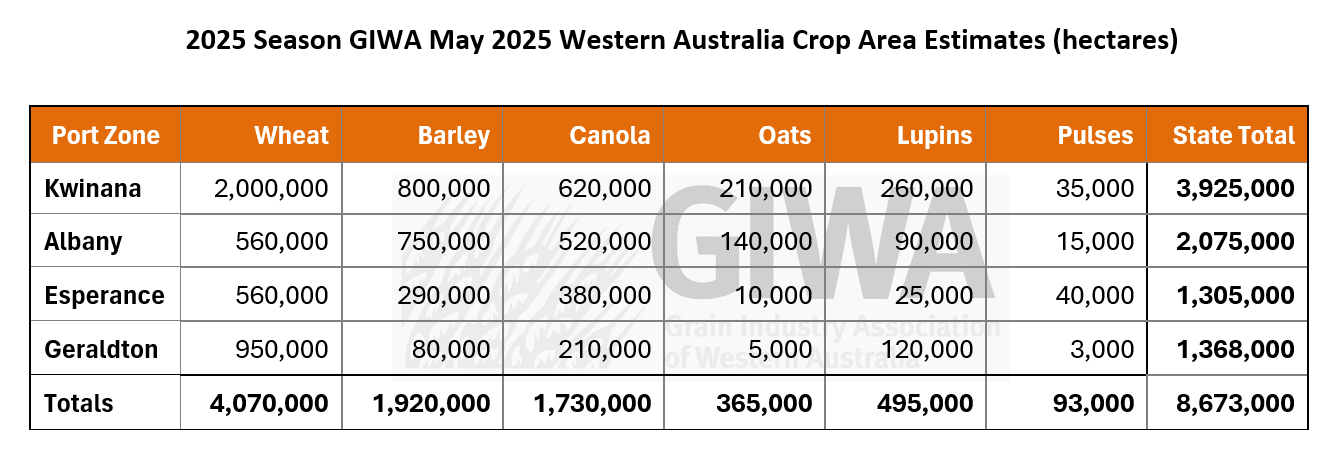

It is still early days and the majority of growers are sticking to their planned crop enterprise mix and intended planted areas for now. The exception to this is a pulling back on break crop hectares in the northern agricultural regions and drier portions of the central cropping zones. Consequently, canola and lupin areas will be down on earlier estimates in the Geraldton port zone and the northeast Kwinana port zone. Fallow area in the low rainfall regions is likely to increase if the rain holds off, reducing the total planned crop area for the state. Although for now the reduction in break crops and fallow is planned for wheat.

The total estimated crop area for Western Australia is slightly down from the April Crop Report due to the persistent dry conditions in the top third of the state’s grain growing regions. The drop off in crop area in the north is being compensated to some degree by extra crop area planted in the southern regions as a result of extra pasture paddocks being sown to crop, and less fallow in the low rainfall regions. There is likely to be a reduction in total crop area in the central regions now due to the patchy rainfall to date.

There is a slight swing back into barley in most regions this year, bringing the area up to where it was a few years ago when barley was above 20 per cent of the total crop area. Wheat area is forecast to be down a few percentage points from 2024 due to a likely reduction in overall area planted. Canola area is forecast to be up slightly from 2024 due to the very good start to the season in the southern regions of the state, but will be well down on the two million hectares of just a few years ago due to the dropping off in area in the very dry regions in the north of the state.

Lupin area is holding firm from some minuses in the north and pluses in the south. Oat area will be up again this year with most of the increase destined for grain rather than hay. Pulses will remain unchanged in the Esperance region and the other southern regions, although there is going to be an increase in pulses in the central regions on the back of some promising results in 2024, particularly with lentils.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate May 2025

Rainfall

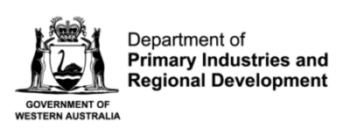

The lead-up to the growing season has seen a marked contrast between northern and southern cropping areas. The north has had little rain (and it has been hot), while southern parts, including the South Coast, have seen above-average rainfall. Estimated root-zone soil water storage is higher than normal for the South West and South Coast, and below normal for the northern agricultural area (see Figure 1).

Forecast

Climate conditions in the Pacific Ocean are expected to remain neutral into winter. Waters over the eastern Indian Ocean are much warmer than normal and are predicted to continue warming into winter. This may lead to a negative Indian Dipole in spring, but forecasts have considerable uncertainty at this time of year.

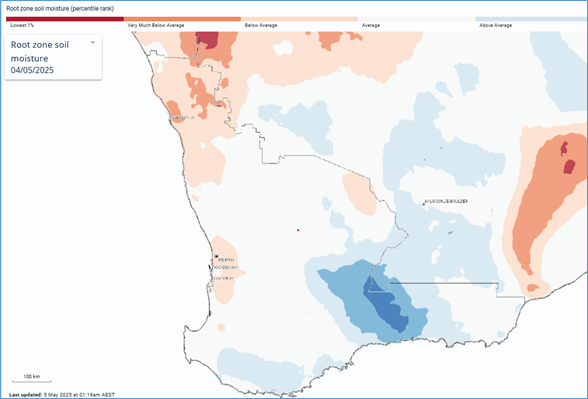

The Bureau of Meteorology’s monthly rainfall outlook for May indicates drier conditions are highly likely. Rain outlooks for June are close to normal, so this is likely to offer break of season opportunities. The seasonal outlook for May to July 2025 is for below-normal rain being more likely (see Figure 2).

Figure 1: Estimated root-zone soil water storage 4 May 2025. Source: Bureau of Meteorology (2025)

Figure 2: Rainfall outlook for May to July 2025. Source: Bureau of Meteorology (2025)

Temperature

Seasonal temperatures over summer have been very much above normal. Seasonal forecasts indicate much warmer conditions will persist into winter.

Additional information is available from:

- DPIRD: Weather stations

- DPIRD: Soil Water Tool

- DPIRD Rainfall to Date Tool

- BoM: Rainfall totals for 2025 to date

- BoM: Rainfall outlook for the next week

- BoM: Seasonal Rainfall Outlook

- BoM: Australian Water Outlook

Geraldton Zone

The dry and hot conditions in the Geraldton region have severely limited planting opportunities for canola and lupins. Despite initial intentions to expand the area of these break crops, the ongoing lack of subsoil moisture and minimal rainfall (around 5 mm for the year in many areas) has forced many growers to fall back on cereals. A lot of paddocks initially designated for canola and lupins have been dropped or swung over to cereals such as barley or wheat, while others are being left to fallow due to weed pressure from 2024.

The canola area is expected to revert back to levels similar to last year of around 200,000 ha, or only 11 per cent of the total arable area in the zone. Lupins are also being dropped out of seeding programs and will likely end up similar to last year when only 120,000 ha were planted. The reduction in break crop area will be taken up by wheat and to a lesser extent barley. As time ticks on without rain, the area of fallow will increase and this will put a cap on the wheat area. Wheat area ended up being just short of 1.1 million hectares in 2024 which was well up on recent years. With a dry May forecast, wheat area will likely be less than that.

Barley has emerged as the go-to alternative recently, particularly short-season varieties like Maximus CL, which perform well on local soils. Many growers now use barley as their break crop due to its reliability and better price outlook compared to wheat. While some hope remains for late-May rainfall, decision-making is being made daily based on short-term forecasts. If conditions don't improve soon, the region is likely to see a reduced total crop area and continued reliance on dry sowing cereals.

Kwinana Zone

Kwinana North Midlands

Conditions across the zone are mostly dry, with crops having emerged best east of the Moora line and west of Dalwallinu and Wongan Hills.

Localised storm events caused uneven germination with some paddocks having crop up and others having none. Early rains helped with establishment in the lighter soils, but the crops on the heavier soils tend to be more staggered.

The rest of the region, particularly west of the highway and extending out through Moora and Dandaragan, has minimal crop up. Light rains have kept some crops ticking along, especially in the good strip west of the Great Northern Highway, but overall establishment is mixed and patchy, with sowing now mostly happening into dry soil. High daytime temperatures (30–33°C) have stressed emerging canola, and recent rainfall was negligible. Canola sowing is wrapping up and most growers are currently focused on barley, with wheat planting recently underway. Pest pressures remain low, and storm-based patchy germination has created highly variable conditions.

Despite the challenges, most growers are sticking to their planned rotations, particularly for canola, which remains essential for weed management and is considered a reliable crop now even with these tough starts. Lupin planting has been delayed or avoided due to risks with poor germination and pre-seeding weed control limitations. If lupins or canola hectares are dropped, they’re likely to be replaced with barley for its weed management benefits.

Kwinana South

Around the Avon Valley canola and lupin hectares are up on 2024. The good start has seen growers switch out paddocks planned for cereals to canola, increasing demand on canola seed and pre-emergent herbicides. Lupin hectares are up slightly this year in the region, not only due to the attractive price but the need to rotate away from cereals and canola. The area under improved pastures and oaten hay is likely to be similar to 2024, despite livestock numbers falling across the region.

The Avon Valley and east toward Meckering received good falls in early April, with some growers sowing canola a lot earlier than the traditional ANZAC day start. These growers that were quick out of the gate where well into their lupin program by the end of May and are now sowing cereals.

Soil moisture levels are more variable in the eastern and northern portions of the zone with very good strips interspersed with strips where very little crop has emerged. Some farmers who received early rain in March and April are doing well, while others are shifting to dry seeding due to the continued dry conditions.

There has been a focus on revising pre-emergence strategies after ineffective rainfall events, with a trend toward post-emergence herbicide application. Crops like oats and canola are generally looking good, although some areas may struggle through May where subsoil moisture is inadequate.

Kwinana North East

Rainfall in the region has been highly variable, ranging from nothing to 70 mm. Most growers have planted their canola now and some have ended up with patchy germination due to rapid downpours causing crusting or little follow up rain following planting. Canola area is down from 2024 due to the patchy nature of rainfall events with growers reluctant to risk too many hectares to dry sowing. There are some very good pockets in the far north-east regions of the zone and the regions east and south-east of Merredin, although these are mixed in with very dry strips of country where very little crop is up.

Lupin planting is mostly finished with a slight increase in area from 2024 for rotational reasons rather than price. The planned barley-wheat split has remained relatively stable and unchanged by market conditions from 2024. The actual area could still change depending on rain, or the lack of it, in the next four weeks.

Most growers are now dry sowing cereals and will continue to until they have about 80 per cent of their planned programs in. It will then be a wait and see game for further rainfall.

Albany Zone

Albany West

Most of the West Albany zone received greater than 50 mm in April which got crops off to a good start. The canola and early sown barley crops are rocketing through their growth stages and are set up for some impressive potential yields if the season kicks on as forecast.

The wet early start had growers nervous about what may be in store this year with a return back to waterlogging being the main limiting factor on whole paddock yields. However, with the dry spell persisting into May, the crops that are up will be drying out the soil profile and setting a good amount of top growth to assist them if the winter rainfall does pick up. As a result, it could be another very good year for the region.

There has been a slight swing back into barley from wheat due to the early start and positive price signals. There have been a few extra pasture paddocks sown to crop as the stock feed situation was looking good a few weeks ago, although pasture feed is tightening up now with the dry conditions.

Albany South

The region has had a very good start from west to east. There are some dry spots, however, most of the region is on track for a good year due to the early planting opportunities. The light top-up of rain in the last week will ensure some of the patchier canola paddocks will now emerge fully. Canola paddocks are now all in and the focus has shifted to barley and the long season wheats. The soil moisture is getting away from some growers and seeder bar set-ups are having to be changed to follow the moisture down to ensure a germination.

Crop plans have largely remained consistent, with no significant deviations from what was planned over the summer. Whilst pasture conditions have deteriorated due to the dry spell, there have not been major adjustments to crop choices as there are generally less sheep to feed now with the continued turn off.

With the crops off to an early start like this, the region is set up for a good year even if the current dry spell persists during May.

Snail and slug populations have been controlled through effective stubble management and hot summers, with fewer issues at the moment compared to previous years.

Albany East (Lakes Region)

The majority of the region has had a good start, particularly in the eastern areas. Rainfall has been lighter in the west and most growers are now sowing dry. East of the north/south line between Kondinin and Lake Grace, around 50 per cent of the area planned for crop is already up and where rainfall has been heavier, there is still enough soil moisture to see another 10 per cent or so be sown into moisture before things dry out further.

Most of the canola, lupins, oats and early barley are in the ground. Growers will move onto dry sowing barley and then wheat in the next few weeks. The area sown to barley, canola and oats are all likely to be up in the region due to the wet early start, and the increase in area of these crops will be at the expense of pasture and wheat.

It’s looking like barley production will be up again relative to what in the region, due in part to the increase in barley area, but mostly due to the barley having gone in early while most of the wheat is yet to be planted.

The oat area more than doubled in the Lake Grace, Kulin and Kondinin Shires in 2024 compared to 2023 and with good prices on offer, it looks like there will be an increase again this year, though likely not to the same extent. Most of the increase in oat area in 2024 went to grain in Kulin and Lake Grace, while in Kondinin the oat hay area went up in a much greater proportion.

Esperance Zone

The zone has had one of the best starts for a while, with significant rainfall events in late March (20–30 mm) and early April (up to 140 mm in some locations) driving strong crop germination and boosting grower confidence. While some early seeding occurred, most of the growers that got the good rains delayed sowing until the optimal sowing window for the varieties being planted. Canola sowing has increased, particularly in the typically marginal areas which this year have the benefit of good subsoil moisture reserves. A small area of about 8,000–10,000 ha of TT canola has had to be reseeded, largely due to surface crusting or seed burial from heavy rain. Some paddocks remain light on for numbers, but germination, especially on the western side, has been amongst the best in recent years.

Barley hectares have also increased, in some cases replacing pulses or pasture. Early ryegrass knockdowns were effective, though some TT canola paddocks now face high weed burdens. Warm days are quickly reducing moisture near the surface, particularly on the eastern fringe, so to prevent patchy germination, growers are now waiting for it to dry out further before starting dry sowing.

Canola crops and the early sown barley crops are pushing through their growth stages, and many are ready for their nitrogen top-ups. Weeds are up and about and this has had spray booms busy. At the moment there are no bug problems, which is a sharp contrast to previous years that have had similar early starts.