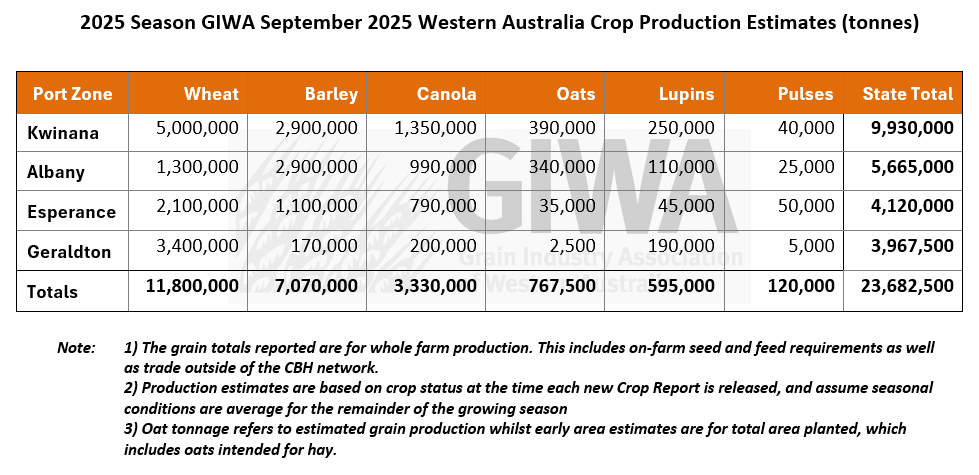

The 2025 Grain Season – The grain growing season continues to improve in Western Australia

The outlook for the West Australian grain growing season has improved over the past month due to mild temperatures and regular rainfall. Rainfall in August was above average for most regions and the rainfall to date in September has been very good and has continued to push the grain yield potential of crops up. Mild temperatures have allowed crops to fill heads without any significant heat shock up until now, which is unusual. The lateness of many crops is the major concern in the central and northern regions as the onset of heat could cause the current above average potential yields to drop back to average. Frost in the central and southern districts could also cause trouble particularly with the later crops that are at the early stages of grain fill.

Irrespective of what happens from now on there will certainly be more than 20 million tonnes of grain grown in Western Australia again this year. This will be the fourth time in the last five years where there has been more than 20 million tonnes of grain produced, whereas prior to 2021, Western Australia had never produced a 20 million tonne crop.

Whilst there are hurdles such as heat and frost to get over in the next three weeks, there is also upside to the current estimate of 23.68 million tonnes if the crop is not overly impacted by heat or frost.

Barley stands out as potentially the best performing crop statewide, with large areas and high yield expectations across all port zones. With just over 1.9 million hectares of barley planted, the second highest area on record just behind the 1.95 million hectares grown in 2019 prior to the halt of trade to China, the estimated 7 million tonnes of barley production this year will be a record by a fair margin.

The canola crop area has nudged back up to 2 million hectares this year and even though it was the crop most affected by the scratchy start to the season, the soft spring has given canola crops time to fill in the gaps and the long flowering period should see some very good yields recorded. The lateness of much of the crops away from the southern regions is a risk if the heat turns up over the next few weeks as many paddocks are still in the final throws of flowering and mid grain fill, which is historically very late.

Wheat crops carry excellent biomass, though many are late and will be more exposed to heat over the next few weeks than normal. Wheat once again will be solid and exceed the five-year average, in part due to the very large area in the ground of just under 4.5 million hectares. The lateness of much of the crop will see current tonnage estimates fall if there is significant heat or frost, but there is also potentially upside to current estimates if the next three to four weeks are mild and the impact from frost is low.

The area planted to oats increased from 2024 and both grain and hay are coming under price pressure due to the very good estimated potential yields. Lupin crops are well grown although the lack of stress has resulted in high biomass to grain ratios which will be more of a payback next year than this year. The pulse crops are all going to yield well this year, which will continue to fuel enthusiasm for the future.

Overall, whilst the grain is not in the bin yet, we are quickly running out of things that could go wrong. The next four weeks will determine the difference between an excellent year and a record year, with the outcome hinging on whether crops can avoid heat shock and maintain moisture to fill grain.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate September 2025

Rainfall

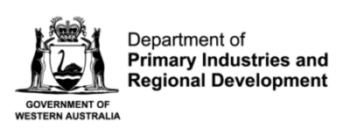

August was wet for most of the cropping area. Combined with widespread rain in the first half of September, much of the cropping region is tracking near average or wetter for the growing season to date. September rain totals are already above average for much of the northern cropping area and parts of the western South Coast. Estimated soil water storage is average to above average for the time of year (see Figure 2); however, this is expected to decline as crops enter their period of increasing water use.

Forecast

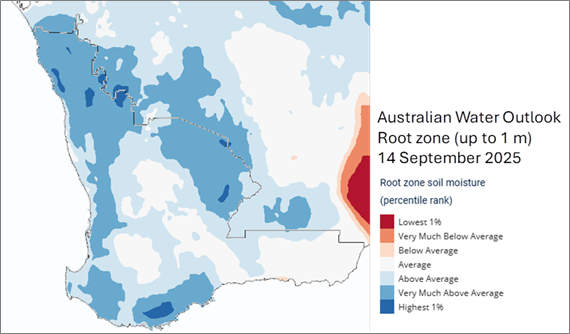

Climate conditions in the Pacific Ocean are neutral and may reach La Nina values briefly in spring. A negative Indian Ocean Dipole event is underway and is expected to decay in early summer. Historically, this can bring wetter conditions during spring over much of inland Australia, with relatively little impact over the southwest of WA.

The Bureau of Meteorology’s seasonal outlook for October to December 2025 is neutral for rainfall over most of WA, in contrast to wetter conditions for central and eastern Australia (see Figure 2). This pattern is likely influenced by the negative Indian Ocean Dipole event.

Figure 1: Estimated root zone relative soil water storage 14 September 2025. Source: Bureau of Meteorology (2025)

Figure 2: Rainfall outlook for September to November 2025. Source: Bureau of Meteorology (2025)

Temperature

August has been near average or warmer, some frosts notwithstanding. Seasonal forecasts indicate a normal risk of low overnight temperatures in September and October. The risk of high daytime temperatures appears near normal in October.

Additional information is available from:

BoM: Rainfall totals for growing season 2025 to date

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Geraldton Zone

Seasonal conditions in the Geraldton zone remain excellent with timely rainfall across much of the region. Rainfall to date is less than in 2024, although the timing has been perfect and spaced evenly through the growing season. Consistent light rainfall at the start of the season with heavier falls towards the end of the season has resulted in good root systems. August and early September rain maintained soil moisture and supported rapid biomass accumulation. Many cereal crops are now into grain fill, with some ultra-quick wheats already finishing. The potential grain yield for cereals in the region currently looks to be above that of 2022. Canola yields are expected to be capped at 1.5–2.5 t/ha due to recent heat events. Canola biomass looks to be 2.5-3 tonne per hectare although with closer inspection, pod fill has still got a fair way to go, realistically pulling yields back to more average levels. Lupins are good but not exceptional, with most of the payback likely to be as benefit to 2026 crops rather than this year.

Many growers are now holding a greater range of variety maturity lengths to accommodate the timing of the break to the season and matching the late break to the quicker varieties, particularly for wheat and canola, which is really going to pay dividends this year.

Kwinana Zone

Kwinana North Midlands

Crops in the Midlands region are currently in good shape, however, the forecast of several hot days coming up poses risks, especially for canola, as root development has not needed to follow the moisture down this year and in the western areas, waterlogging has impeded root development. All crops have had ample moisture, although the limited root development will make them vulnerable to sudden heat.

Barley crops are extremely well grown, and while early frosts have resulted in some blank heads, it is regarded as the “shining light” this year with crops well into grain fill and relatively disease free. Wheat is later with many crops yet to flower and therefore more exposed to the forecast warm spell. Whilst there has been some powdery mildew, septoria, and localised cereal aphid pressure in the wheat, most crops are holding up well.

At this point in time, it is likely yields will exceed last year’s results but fall short of the record seasons of 2021 and 2022 due to waterlogging in some areas and a shorter growing season. Harvest is expected to be slightly delayed, with barley likely to be the first crop harvested in early November, ahead of canola.

Overall, the season is still shaping up very well, although the upcoming heat and lack of deep root development remains a key risk.

Kwinana South

Crops in the higher rainfall regions of the Kwinana zones have continued to improve during the last month. The staggered germination in the region and lateness of crops in some areas will reduce the likelihood of the region reaching the grain tonnage of 2022. Growing season rainfall has been less than 2022 to date and the many mild frost events will take the “top” off crops in the region this year, where there was little or none in 2022. The areas that did germinate prior to the general break in mid-June will come close to matching 2022.

There is more crop area planted in the zone this year than 2022 due to the adjustment out of sheep in the eastern shires and this will help to push the total grain production up. The western areas of the zone were very late germinating, and while they now show greater potential than 2022, their delayed start is likely to hold them back.

Kwinana North East

The Kwinana North East zone has experienced a remarkable turnaround, shifting from a decile 4-7 for potential in August to a decile 9-10 now following widespread rainfall over the last month. Crops are carrying large biomass and have bulked up significantly in recent weeks but are relying on limited subsoil reserves, raising concerns about the finishing potential.

Despite the visual strength of crops, there is little subsoil moisture, meaning potential yields may not be realised unless more significant rainfall arrives.

Wheat crops are later than usual with some just emerging from the boot and others still flowering. The earlier emerging crops are more advanced and will be in a better position to handle the upcoming heat. Yields for cereals are likely to finish in the 2.5–3 t/ha range, with canola 1.5–1.8 t/ha in the better areas where crops emerged early. On the eastern fringe, grain yields for wheat of 1.8–2 t/ha are likely, which would still be above average. Barley crops sown early look excellent, while later crops are more variable. The season will not match 2022’s highs due to lack of stored moisture, and hot winds remain the biggest short-term risk.

Albany Zone

Albany West

Early in the season crops looked record-breaking, but heavy rainfall and subsequent waterlogging through July and August has reduced yield potential in western areas back to a “solid average.” Crops in the eastern part of the zone remain excellent, and those around Jerramungup have the potential to be record-breaking where waterlogging has been less severe. The areas around Ongerup and Gnowangerup were more constrained by waterlogging and a later start.

Crop development is even across the region, with barley at mid–grain fill and canola ranging from full bloom to coming off flower, broadly in line with the northern zones.

Barley growth this year in the region has been very good, with Neo CL widely grown in the west and Maximus CL in the east. Both are performing well, though scald pressure has been an issue in Maximus CL where fungicide application was delayed.

Canola has very good grain yield potential but is patchy in wet paddocks. The Photothermal Quotient (PTQ) index for canola has been high, suggesting strong potential despite cloudy conditions. A swing away from Roundup Ready canola is evident, with more Clearfield® and TT varieties being grown this year than in 2024.

Albany South

The South Coast is still waterlogged, with persistent rain adding to already saturated profiles with many areas having received 100 mm in late July, 80 mm in August, and roughly 80 mm so far in September. Despite the saturation, the majority of crops are early sown and are holding on well. Canola is lodging in windy conditions, signalling oxygen-limited soils, yet canopies remain green. Tile drainage has been very effective at removing substantial volumes of water and drained areas are often the only trafficable ground.

Disease pressure has been manageable, with sclerotinia levels in canola generally low. Isolated paddocks have up to about 5 per cent stem infection and one fungicide application has commonly been sufficient. Aerial blackleg is present but is not expected to dent yield significantly, though seed may need to be cleaned before delivery.

Looking ahead, barley is the standout and should finish well. Wheat is the crop most affected by persistent wet feet, particularly the later-sown paddocks. A minor frost occurred a few weeks ago but doesn’t look to be a major issue. Some very early Brumby wheat “bolted” in the cold, leading to low tiller numbers and is expected to hit a ceiling of 3 t/ha, although most of the main season wheat still looks solid. Oat area ticked up slightly, but price softening for oat grain and strong domestic hay market has uncontracted growers eyeing a switch to hay, but this is conditional on securing a drying window to cut and cure the hay.

Overall, it’s a wet but resilient season, with drainage, timing of sowing, and harvest weather windows likely to determine final outcomes.

Albany East (Lakes Region)

The Lakes district was on track for another very good year, but several frost events have taken the shine off the potential yield for many. The eastern and southeastern fringes have been impacted the most, as have the low-lying areas further west. All crops at vulnerable growth stages have been hit to some extent and with another frost event last weekend, it will be several weeks until the full impact is known. The district has had a relatively frost-free run in recent years and as it is a known “frosty region,” growers are not particularly perturbed as frost is just a part of life. Even so, grain yields will be close to average or above average for those less impacted.

Esperance Zone

Crops in the Esperance port zone have continued to improve in the last month with consistent rainfall in August and September maintaining crop potential. The very wet end to July caused canola losses on the coastal plains and some wheat setbacks. Barley has held up well, with many crops likely to yield over 5 t/ha, making it the standout performer this year. Wheat crops have developed huge biomass and carry high yield potential, though they remain vulnerable to heat events and will require mild conditions and timely rain through late September and early October to finish well.

Canola crops are generally excellent, but patchiness remains in some paddocks, with hybrid varieties looking to have higher grain yield potential than the open pollenated varieties again. A frost event two weeks ago reduced yield potential in parts of the Mallee, Grass Patch, Cascade, and Beaumont, with wheat most affected.

The major issue has been powdery mildew in wheat, with agronomists in the region describing it as one of the worst they have seen. Even with established fungicide strategies, requiring more than one spray. disease pressure has remained extreme, with varietal resistance levels showing clear separation between varieties. Barley disease pressure has been low, aided by the wholescale switch to varieties with greater genetic tolerance. Insect pressures include widespread cereal aphids and isolated Diamondback Moth in canola. Pulses are exceptional, with beans, lentils, and peas looking the best they have for several years.

Despite frost and severe disease pressure, the overall outlook remains for a very strong harvest across the zone, potentially better than 2022 in parts, although with variability between soil types and cropping systems.