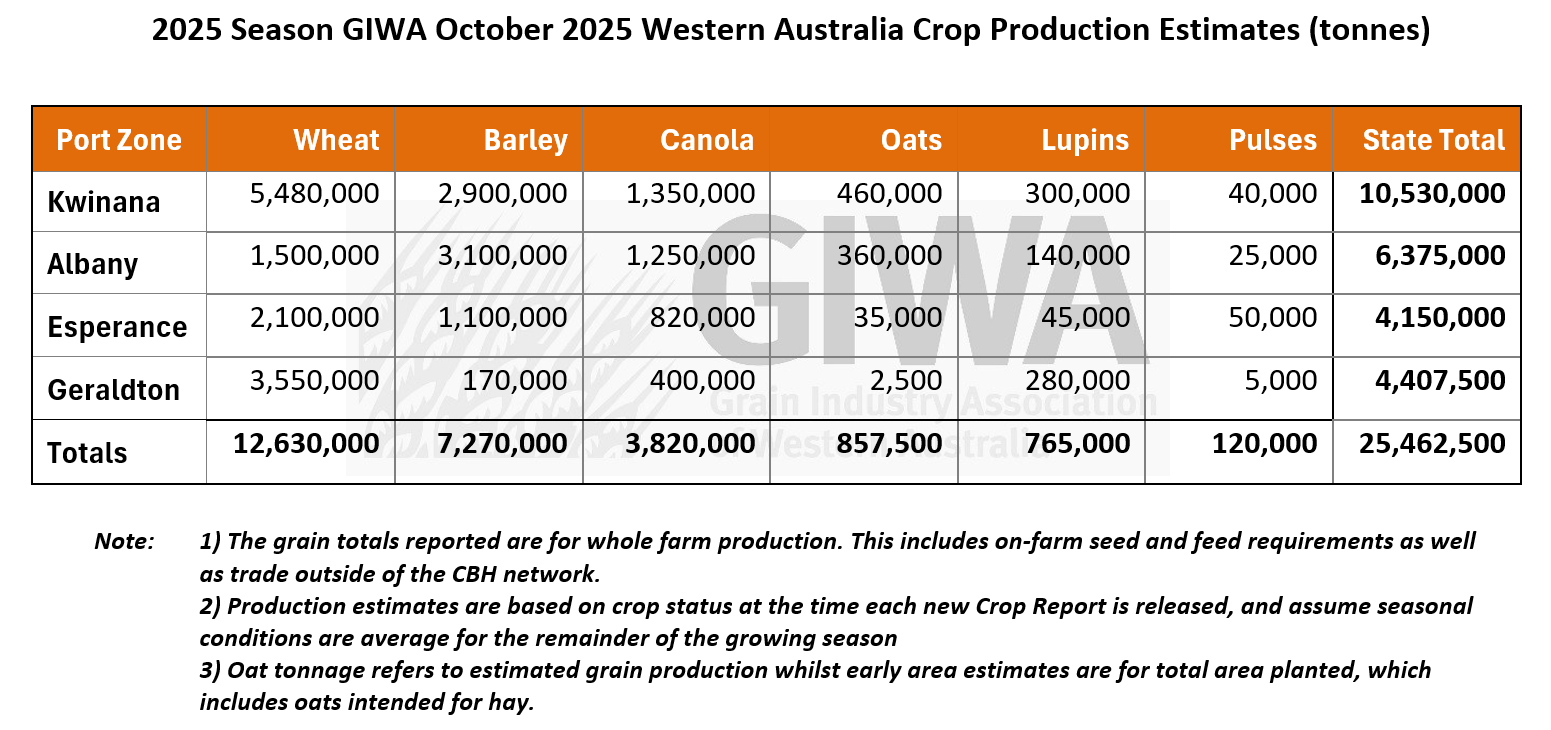

Total grain production in Western Australia will come close to and may even exceed the record production year of 2022

Despite the Western Australian grain crop yield potential having slid recently in the medium rainfall central regions of the state, the state is on track to come close to or possibly exceed the 2022 season’s record production. While little useful rain has fallen during the critical grain-fill period, the good areas to the north, west and south of the state are very good and have a similar potential to 2022. On top of this, the total cropped area is around 500,000ha (6 per cent) more than in 2022 and 300,000ha more than in 2021, which is the state’s second highest grain production year.

In the higher rainfall zones, as more farmers get out of sheep there has been a significant shift from pasture to crop and the cropped area has increased by about 15 per cent in the last four years. The crop mix is also quite different with more barley and less canola in 2025 than in 2022. Barley generally yields around twice as much as canola irrespective of the rainfall zone and the large barley crop this year is probably going to be the star performer, contributing more than 30 per cent of the total grain in the state. The combination of these factors means the “top coming off the crop” in the central regions could be made up elsewhere, resulting in another record production year.

GIWA’s September Crop Report highlighted the potential impact of frost and heat shock on total production should either if these events occur during the remainder of September and early October, but both have been minimal, and whilst there have not been the finishing rains in the last month across all regions to push yields higher, potential yields have held in all areas other than the central region.

Cereal grain quality is expected to be good as grain fill is ticking along nicely with most growers reporting good grain size as crops approach maturity. Grain protein is likely to hold even where the yields are going to be above average, as there has been significant practice change in the last four years with growers applying more nitrogen than just a few years ago. This was quite noticeable all year in the colour and health of crops. In addition, the rapid adoption of controlled release nitrogen products is resulting in nitrogen use efficiencies increasing to a point where the dilution in protein that occurs with high yields looks to be a thing of the past, except where grain yields have pushed well beyond what growers anticipated and fertilised for.

Harvest is just starting in the Esperance zone on early sown barley and canola crops and is expected to begin in the Kwinana and Geraldton zones from late October and early November — around one to two weeks later than normal.

Several light frost events during spring caused some flower frost in wheat and barley in low lying, susceptible areas of the central regions. These areas have had the top taken off grain yields, but the impact on the state’s tonnage will be minimal. Light levels of flower frost usually results in larger grain in affected heads rather than higher screenings, as those grain fill sites that are lost are compensated by unaffected sites which take up more nutrients and produce fewer but plumper grains. In the more severely frost affected areas, growers are expecting some yield reduction and higher screenings.

Wheat production in the Geraldton, Albany and Esperance port zones is likely to be greater this year than in 2022, while production in the central regions of the Kwinana zones will be lower due the late start and lack of finishing rains. There are some bright spots in the lower rainfall fringes in the central regions of the Kwinana East zone where growers jagged some useful falls of rain around the end of September and these crops will now be above average.

Barley crops have looked sensational all year. The 2025 season has suited barley across the state and with more than 7 million tonnes expected to be harvested, this will be the largest barley crop on record. Grain size and protein are expected to be good in most areas with the early flowering allowing time to fill heads and the warm soils and soil moisture allowing more soil nitrate mineralisation than normal.

Canola grain yields will be mixed as much of the crop had to make up ground during the winter to fill the gaps left from the scratchy start. The extended grain fill period has helped to give crops time to branch out and set more pods, although in the central regions the lack of rain during the last six weeks has put a lid on grain yields. Canola crops are exceptional in the higher rainfall regions of the Geraldton, Midlands, West Albany, South coast and Esperance zones and this is where the big tonnes will come from.

Lupins have benefited from the mild conditions in the last month giving more time to fill the pods that were set and yield estimates have been lifted across the state since the last report.

As hay cutting is still underway, it is difficult to predict the final outcome, but it is likely that the ratio of oats harvested for grain and that cut for hay will be similar to past years. However, with the increase in total area planted this year, total oat grain production will definitely be higher than it has been for many years.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate October 2025

Rainfall

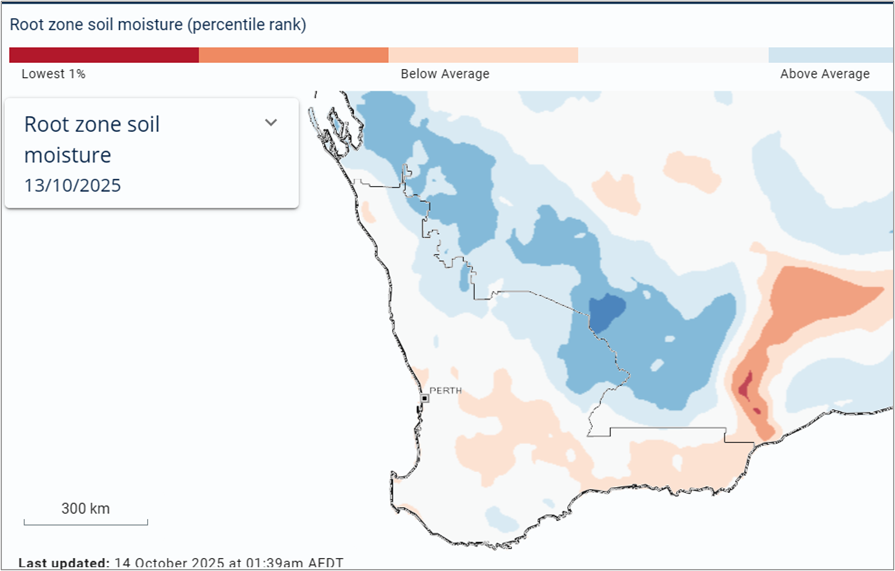

September rain was near average across most of the agricultural area, continuing the pattern of average to wetter conditions since July. Rainfall totals since April are now above average in many areas. Early October brought a short period of high temperatures, followed by a cloud band bringing late-season rain to eastern and northeastern parts of the agricultural area. These areas have above average soil water reserves for the time of year, however, soil water is declining in other parts (see Figure 1).

Forecast

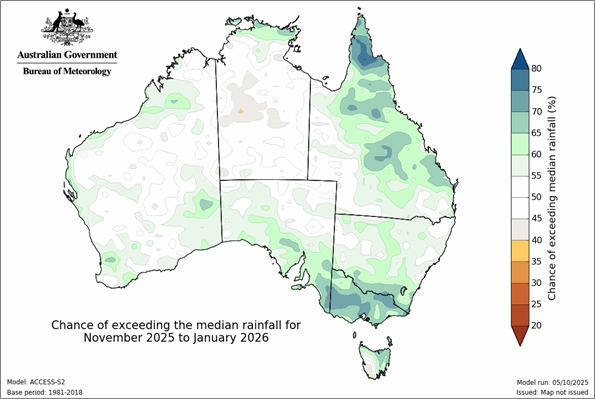

Climate models predict a weak La Nina event to develop in the Pacific Ocean and to last until late summer. A negative Indian Ocean Dipole event is underway and is expected to decay in early summer. Historically, this can bring wetter conditions during spring over much of inland Australia, with relatively little impact over the southwest of WA.

The Bureau of Meteorology’s seasonal outlook for November 2025 to January 2026 is neutral for rainfall over most of WA, with wetter conditions for parts of eastern Australia (see Figure 2). The wetter outlook for the east has weakened since the previous update.

Figure 1: Relative soil water storage at 13 October 2025. Source: BoM (2025).

Figure 2: Rainfall outlook for October 2025 to January 2026. Source: Bureau of Meteorology (2025)

Temperature

Daytime temperatures have been above normal in September, while nights have been cooler over central areas, with some frosts. Seasonal forecasts indicate October and November are likely to be warmer than average, although the risk of extreme temperatures is not particularly elevated.

Additional information is available from:

BoM: Rainfall totals for growing season 2025 to date

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Geraldton Zone

The northern region has had one of its mildest finishes to the season in years, following 10–20 mm of rain and unseasonably cool mid-October conditions. The mild weather has supported excellent grain fill, particularly in wheat and barley, with many crops expected to match or exceed 2022 yields. Barley will be the first crop harvested, though most crops remain green, pushing harvest timing into late October and early November which is unusually late for the Geraldton port zone. Waterlogging has been minimal this year, and grain quality is expected to be bright, plump, and heavy.

Sclerotinia has become widespread in both lupins and canola, with most medium to high rainfall lupin paddocks receiving one or two fungicide applications. The disease is now a significant management issue across the northern agricultural zones and further south in the Midlands and will gain more significance as the break crop area in these regions increases.

Overall, the Geraldton zone is set for an excellent harvest.

Kwinana Zone

Kwinana North Midlands

Harvest across the Midlands is expected to begin slightly later than usual, with most growers not expecting to get underway until early November. Barley and lentils will be the first crops harvested. Recent rainfall of 10–20 mm combined with good subsoil reserves has supported a softer finish than in 2024. Barley crops have looked good all year, so barley is likely to be the region’s standout crop, but both canola and wheat are also finishing well under mild conditions.

Budworm numbers have increased rapidly, and with small larvae now widespread, it is proving to be a particularly bad budworm year across the state. However, this has not really caused major issues as the early warning systems in place pick up moth flights and give growers plenty of time to plan for control measures. Canola yields will be below 2022 levels due to earlier waterlogging and late establishment, while wheat yields are solid but not exceptional. Even though conditions across the whole of the Midlands region are not quite as good a 2022, total production is expected to match 2022 levels driven by an increase in the area planted to cereals, mostly barley which replaced pasture. The decline in pasture has been significant in the western regions of the zone with shires such as Dandaragan down 20 per cent from 2022.

Kwinana South

The central and southern wheatbelt has seen yield potential fade following a dry finish and several short heat events in early October. Rainfall totals of only 5-10 mm were insufficient to sustain top-end yields, and subsoil moisture reserves are now depleted. Frost events in early September caused scattered head damage in wheat, and moisture stress has further limited grain fill across large areas.

Barley crops look to be retaining reasonable potential, though frost is likely to reduce yields by around 10 per cent, with some shrivelled grain expected. Wheat has been more affected, losing top-end yield and finishing unevenly in susceptible areas of paddocks. Budworm infestations have been well controlled, and disease pressure remained low through spring. Despite the dry finish to the season, most growers expect an average harvest, however, low grain prices are likely to reduce profitability compared with recent years.

Kwinana North East

The north-eastern wheatbelt has tightened quickly through October after most districts received less than five millimetres of rain early in the month. The low rainfall fringe areas along the line from Morawa to Latham and north and east of Merredin fared better with 20–30 mm, helping hold some yield potential. Many of these crops will be above average with yields around 2.5t/ha expected in the better paddocks. The western parts of the northern portion of the zone are very good as well. Wheat yields are expected to sit around 1.8 t/ha, ranging from 1.3–1.4 t/ha on cereal stubbles to more than 2.5t/ha on fallow in the southern portions of the zone.

Heat stress and frost have both taken a toll on crops, with long-season canola on lighter soils suffering flower abortion and poor pod set. Insects have been managed effectively, with widespread spraying for budworm in pulses and canola, and limited Diamondback Moth (DBM) activity.

Barley potential has been reduced, especially through the Bencubbin–Koorda corridor where some paddocks are unlikely to be harvested, but thankfully this very poor patch is not huge in area.

Oat area has expanded considerably north of the Great Eastern Highway again this year. Grain yield and quality will be mixed due to the tight finish in the region.

Albany Zone

Albany West

The Albany West zone has continued to improve in the last month with waterlogged paddocks drying out and the mild conditions allowing the later emerged crops to fully fill their potential. The region had an early start to the growing season and crops that were sown early have taken advantage of the good growing conditions. Disease and insect pressure has been low all year, as it has been right through the higher rainfall western corridor. This lack of stress usually contributes to above average grain yields, which is going to be the case this year.

Grain size in canola and barley is looking good as crops begin to dry off, and the wheat is mostly still green indicating crops in the region have not exhausted soil moisture reserves yet and will probably fill grain heads well.

There has been more waterlogging across the region than in 2022, reducing the effective crop area by around 10 per cent.

The total tonnage for the region is going to be boosted by increased crop area this year as pasture gives way to crop. Illustrating this, crop area in the Plantagenet shire is up by around 15 per cent, and Cranbrook and Woodanilling shires are up by around 20 and 16 per cent respectively.

Albany South

The start of harvest in the southern and coastal regions of the Albany port zone is likely to be at least two weeks later than normal due to the mild spring weather. This extended grain fill period will add a lot of tonnes in the well grown crops that did not suffer from waterlogging during the winter. The saturated portions of paddocks are showing up now where the crops have finally succumbed to having had wet feet for most of August and September. The area lost to these portions of paddocks is generally less than 10 per cent of whole paddocks and the lost production will be compensated for by the non-waterlogged areas of paddocks.

Barley and canola crops are in the later stages of grain fill with both plump and few missing grain development sites in the heads. Wheat is trying to fill 4 grains wide, which only occurs in rare circumstances.

There has been virtually no rain during the grain fill period for most crops, although as rainfall averages climbed back up to normal during the final weeks of winter and conditions have remained mild, it is expected that crops will yield similar to 2022. In the past, the lack of finishing rains was considered a major limiting factor to achieving high top end potential, but in recent years crops have been in a similar situation to this season and went on to surprise both growers and agronomists alike with how much grain came off the paddocks.

Albany East (Lakes Region)

The district received early rains, and most regions were able to sow and get crop up in May, rather than in June which was the case further north. The resulting longer growing season has meant the region has been on track for a very good year for a while now. The region escaped the frost prone period relatively unscathed, apart from those areas lower in the landscape that regularly receive damage. The central and eastern areas of the region also received 10–20 mm of rain two weeks ago, which has finished off crops nicely. The western portions of the zone were not so fortunate and needed more than the 5–7 mm which fell for crops to reach their potential.

Across the whole zone the top end potential is considered behind that of 2022, but with the exodus of sheep resulting in more crop area this year, and this being mostly barley which looks good right across the region, the end result will likely see 2025 nudging 2022 for total tonnes produced.

Esperance Zone

Harvest is underway in the Esperance zone, beginning with canola and barley as warm weather speeds maturity. Rainfall through August and late July boosted crop yield potential in the early sown crops, although September and early October were comparatively dry, with 40–50 mm falling along the coast and 20–30 mm inland.

The mild temperatures have supported good grain fill, with early sown barley crops likely to yield well above average. Canola crops have good grain size and are likely to perform better than a casual visual estimate suggests. Wheat crops are still filling heads and though yields are expected to be good, they will probably not match those of 2022.

In parts of Beaumont, Scaddan, Cascade, and Grass Patch frost damage is evident in wheat, although the less affected portions of these paddocks are expected to make up ground in yield. Powdery mildew was severe in wheat paddocks where preventative fungicide applications were delayed and once it got going, it was very difficult to control. These paddocks will be down significantly on yield and grain quality compared to the well managed paddocks and those planted to more resistant varieties.

Budworm and DBM have been widespread in canola although early action has limited grain yield impact. Sclerotinia infection in both canola and lupins has been high this year.

Lentil, bean, and pea crops look excellent.