Growing season rainfall totals pick up dramatically in the last month

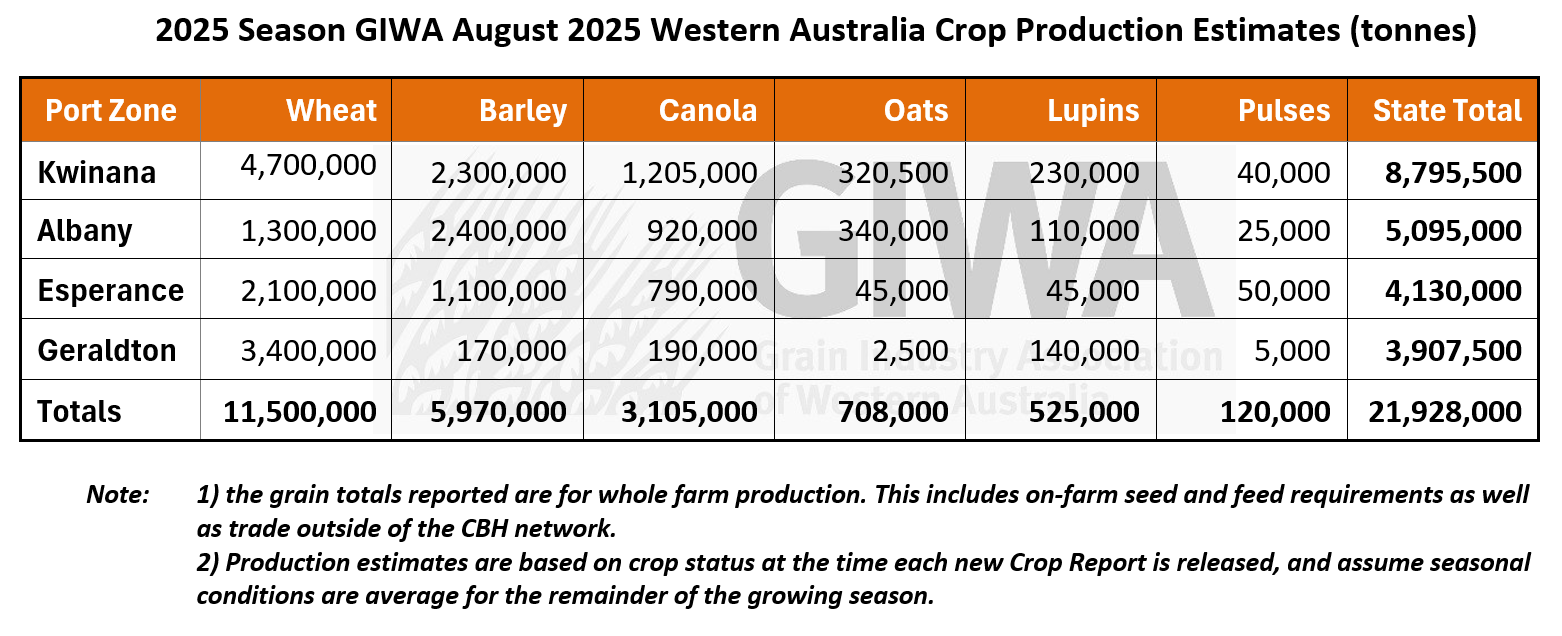

There are now few areas in the grain belt with less than 200 mm of year-to-date rainfall and with growing season rainfall sitting at decile 5 or greater for most regions, the potential for 20 million plus tonnes of total grain production for Western Australia is there once again. If recent history of water use efficiency is anything to go by and conditions in spring remain favourable, crops will easily convert this rainfall to another near record grain production year.

There are a few pockets of below decile 5 growing season rainfall in the medium to low rainfall regions and the tick up in rainfall during July and early August has come too late for substantial recovery in these areas. However, the areas closer to the central west coast that still sit below decile 5 have time on their side and with an average spring forecast firming, crops could hit very good grain yields despite rainfall to date being below average.

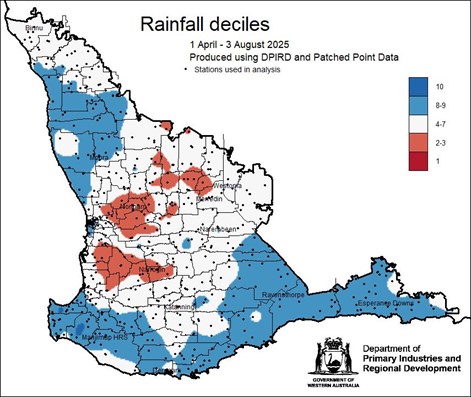

The west coastal, south coastal and southern Esperance zones are now too wet in places, and this will impact on whole paddock averages. Crops in these regions mostly emerged early and their growth stage is more advanced than normal for this time of the year and their biomass will help them combat transient waterlogging. But those areas where the soils are at field capacity now will be down on grain yield potential.

Crops away from the coastal strips where rainfall in the last six weeks has been less are now in very good shape as they are currently in that sweet spot of biomass accumulation without the waterlogging. The final grain yield in these areas is going to be highly dependent on the finish to the season as subsoil moisture reserves are low heading into spring, and the crops are relatively late in development. These crops will need a mild finish to dodge heat shock, and rainfall totals will need to be at least average from now on to hit current grain yield potential.

With an average finish to the season wheat production will exceed 10 million tonnes, despite the area planted to wheat being down by around 700,000 hectares from 2024 due to wheat being substituted for barley in the southern and southwestern regions where the break to the season was earlier. Barley production will be more than 5 million tonnes and canola more than 3 million tonnes. The three major crops all show real potential to hit recent five-year averages of 11.2 million tonnes for wheat, 5.2 million tonnes for barley and 2.8 million tonnes for canola.

Oat plantings are up from 2024 with most of the extra area intended for grain at planting. Current grain yield potential looks similar to last year, which could push production over 700,000 tonnes depending on the split between oats for grain and oats cut for hay. Lupin crops are very good in the north but decline progressively as you go further south where the cold growing conditions have held them back. The slight increase in pulse plantings, particularly lentils, faba beans and field peas, will result in higher tonnages than in recent years as most are growing well and have good grain yield potential.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate August 2025

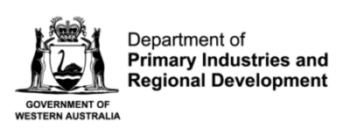

Rainfall

July was wet for the South Coast in particular, as well as the Midwest. Combined with widespread rain in early August, much of the cropping region is tracking near average or wetter for the growing season to date (see Figure 1). Central and northeastern areas remain below average to date, though rainfall deficits are decreasing. Estimated soil water storage follows this pattern, with the South Coast showing waterlogging in parts. Follow-up rain is expected into mid-August.

Forecast

Climate conditions in the Pacific Ocean are expected to remain neutral. Climate models continue to predict the development of a negative Indian Ocean Dipole in spring. Historically, this can bring wetter conditions during spring over much of inland Australia, with relatively little impact over the southwest of WA.

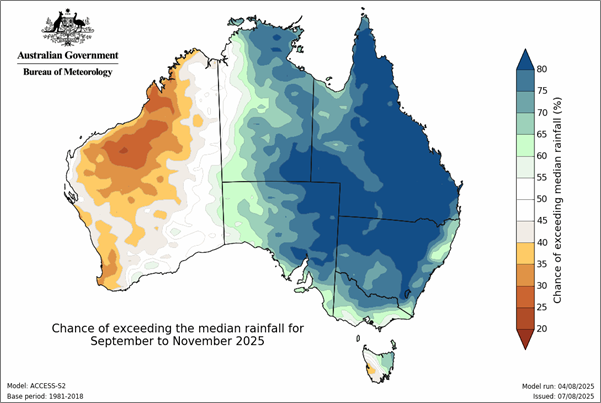

The Bureau of Meteorology’s monthly rainfall outlook for September indicates a preference for below-normal rainfall for the South West, with near-normal rain expected in most cropping areas. The seasonal outlook for September to November 2025 is for below normal rain being more likely over most of WA, in contrast to wetter conditions for central and eastern Australia (see Figure 2).

Figure 1: Rainfall deciles for 1 April to 3 August 2025. Source: DPIRD (2025)

Soil water, Two-layer crop Ritchie model, 10 Aug 2025. Source: DPIRD (2025)

Figure 2: Rainfall outlook for September to November 2025. Source: Bureau of Meteorology (2025)

Temperature

July has been cold, breaking the run of above average temperatures that prevailed for April to June. Seasonal forecasts indicate a normal risk of low overnight temperatures September and October. Daytime temperatures appear near normal in October.

Additional information is available from:

Geraldton Zone

Crops in the Geraldton zone are about a week ahead of last year, with excellent establishment right across the zone. Year to date rainfall in the zone has been around 100 mm less than in 2024 to date, although the very even crop development right from the start and the lack of waterlogging this year could potentially see more grain produced in the zone than 2024. But with subsoil moisture reserves low at the moment, spring is going to need to be on the milder side for temperature, together with more rain to hit current yield potential.

Rainfall variation between the western and eastern zones is significant, and with the eastern fringe sitting on less the 200 mm of growing season rainfall (GSR), it will require timely August and September rainfall to maintain current crop potential. A mild, wet September would set the region up for an excellent finish, while a hot, dry month could erode yield prospects very quickly.

Short-season canola types are flowering earlier than expected, with longer types nearing peak bloom. Lupins are among the best in years, with improved vigour where clethodim rates have been reduced, although herbicide resistance to weeds and crop damage remain issues.

A major development has been the rapid adoption of green-on-green camera spraying technology, which is enabling targeted weed control in lupins and canola while significantly reducing the volume of herbicide required.

Pest and disease pressure is minimal, with only light budworm activity detected in traps. September rainfall will be critical to achieving above-average yields.

Kwinana Zone

Kwinana North Midlands

The Kwinana North Midlands region has seen a strong turnaround after very high July rainfall, with some paddocks receiving over 200 mm in that month alone. August has also been wet, particularly on the western sandplain. Nitrogen applications have increased beyond planned levels, with the majority of late applications now being by air due to wet conditions.

Sclerotinia sprays in canola are underway, with early crops already treated and later crops receiving their main pass now. Waterlogging is emerging as the main yield constraint, affecting about five per cent of the landscape. Early-sown canola is flowering ahead of schedule, increasing frost sensitivity.

Cereal crops remain in very good shape with high yield potential. Lentils are performing well with improved varieties and fungicide programs, and later-sown lupins are strong despite early patchiness.

With crops at similar growth stages to last year on a much stronger moisture profile, the region is well placed for a strong finish if the spring conditions are kind.

Kwinana South

Seasonal conditions in Kwinana South have improved in the last six weeks with GSR lifting from decile 1 after a very dry start to now around decile 4–5. While some early sown pockets missed key July and early August rain and crops in these areas remain variable in potential, most crops are in a position to benefit from late nitrogen applications, with many growers now betting on a wet mild spring based on long range forecasts.

Early-sown canola in frost-prone areas suffered during a prolonged cold period in July. However, they are recovering now and whilst compact, are in full bloom and have very good grain yield potential. Waterlogging in low-lying areas is still affecting tiller survival in cereals. Lupins in some paddocks are performing better than expected.

Barley remains largely disease-free, with low levels of spot-type net blotch, and wheat diseases are minimal. Aphid presence is patchy, with no major outbreaks. Blackleg pressure spiked in late July, raising concerns over pod infection risk.

Yield prospects are now considered average or better in many areas, although late sown and frost affected paddocks may fall short. September rainfall and cooler temperatures will be decisive in determining final grain fill and overall yield. Although frost-affected and later-sown paddocks will underperform.

Kwinana North East

Crops in the north-eastern areas of the zone now look good except on the perimeters around Goodlands, and whilst those to the east have improved, they are now running out of growing season to be able to recover enough to hit anything more than average grain yields. Many of these areas have had less than 100 mm of GSR to date, with the majority of this turning up in the last month. Apart from the very poor areas north of Bencubbin and Mukinbudin, the crops generally look much better than the rainfall would suggest.

Crops in the areas that received stripy rain at the start of the season have emerged at a range of timings and this unintended stagger in growth stages could end up being a useful frost mitigation strategy if it ends up being a frosty spring.

As with last year, the region has the potential to produce a lot of grain due to the large areas of wheat planted but it needs a few more 10-15 mm+ rainfall events and mild spring temperatures.

Albany Zone

Albany West

Yield potential across the region is generally above average thanks to strong soil moisture profiles, improved varieties, and sound agronomic practices, though waterlogging could reduce yields by about 20 percent in affected areas. In the eastern portion of the zone around Jerramungup, growers are experiencing the wettest July since 1912. Later-sown crops should still perform well due to the typically long and mild grain-fill period in the south.

Growth stages vary widely due to sowing dates, with early cereals at flag leaf emergence and later plantings at early stem elongation. Canola ranges from the start of flowering to over 50 per cent bloom. The difference in emergence timing has been evident all year and continues to play out with those that got the jump at the start of the season having grain yield potential well above the later germinating crops.

Localised lodging in cereals has been observed, along with minor frost damage in low-lying paddocks. Later-sown lupins are developing more slowly, and early fungicide applications have been applied on some barley crops to maintain clean canopies.

Livestock prices are trending upwards, improving sentiment among producers, and livestock remains a core component of farming systems in areas unsuitable for cropping. Pasture area has contracted slightly, but many paddocks are still allocated to fodder production for grazing, which may not be fully captured in modelling or imagery data.

Overall, the season is shaping up as another strong year for the southern region, with waterlogging being the main risk to yield.

Albany South

The Albany South region is on track for a strong year, with recent rainfall events delivering 100–180 mm over a 10-day period, topping up soil profiles and benefiting previously dry areas. While some coastal flats, particularly around Gardiner, have experienced localised waterlogging in canola, the impact is limited in percentage terms.

Varietal differences in canola performance have been very clear this year with some varieties running up unexpectedly during the dry period following the early planting whilst others held back nicely to allow for biomass recovery once it rained. The difference between varieties with final grain yields are likely to reflect this year more than in the past.

The small area of early sown winter wheats are proving their worth and if the grain yields stack up at harvest, the trend of planting cereals early will probably continue in the future.

Wheat growth is variable, with some excellent crops in South Stirling and Mount Barker, but thinner, patchier crops in medium rainfall areas. Oat plantings have increased due to strong prices, and crops are generally looking to perform at or above average. Barley disease overall is low, except for the barley-on-barley paddocks where both net type and spot type net blotch have needed multiple fungicide applications. Wheat disease levels are low, with traces of mildew and rust, while canola sclerotinia incidence is late and limited.

Overall, there is the potential for an above average year in many areas if September remains mild, although the timing of rainfall events during the grain fill period will be critical to convert the current potential to grain.

Albany East (Lakes Region)

The Lakes district of the Albany port zone sits snuggly between the drier areas to the west and northeast where rainfall totals have only recently pushed up to average for the year. The early start has pushed crop growth ahead of where they would normally be in early spring and as the region is known to be a bit frosty, clear cold nights are looming as the greatest threat to grain production in the region.

Esperance Zone

The whole of the Esperance port zone is sitting on decile 8 or more for GSR. All crops are well advanced for this time of the year due to the early start across the region. Recent rainfall has pushed soil profiles to field capacity for many portions of the zone and closer to the coast there is waterlogging across large areas which will put a dampener on a potentially brilliant year for the region. The lower rainfall regions north of the coast are set for a very good year as they have had the rain without out waterlogging.

With soil moisture profiles topped up and crops close to grain fill, heat shock is unlikely to be a limiting factor on yields. Final grain production will be dependent on how the wet areas recover and if frost turns up to take the top of grain yields as it did a few years ago.

Where they have been able to get onto paddocks, growers have been progressively topping up cereal crops with nitrogen to make the most out of the rainfall as the rainfall totals have crept up. The wet conditions have been perfect for leaf diseases such as powdery mildew in wheat and a range of diseases in pulses, but growers are well versed with disease management in the region and the spike in leaf disease in all crops this year should not have a major impact on the final result.

GIWA gratefully acknowledges funding received from the State Government funded, industry-led Processed Oat Partnership program which has funded increased ground truthing in 2024 and 2025 to better estimate total oat planting area and better estimate the split between oats sown for grain and oats sown for hay production.

.