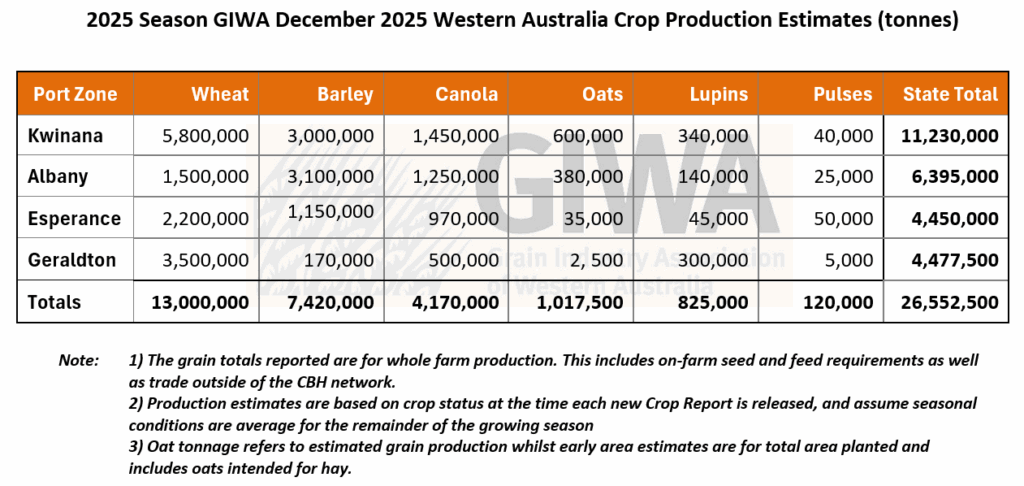

The tonnes are starting to stack up as the Western Australian grain harvest gets into full swing

The Western Australian grain harvest is past the halfway mark now based on the expected production estimates at the start of harvest. The Esperance port zone is the furthest advanced with some growers winding up this week and growers in the Geraldton port zone only have another couple of weeks to go. Based on deliveries to date, both these port zones will finish up close to the tonnage estimates reported in last month’s Crop Report.

The Kwinana and Albany port zones both have a fair way to go, particularly in the western areas where crops are much later maturing than normal. The results from these zones are quite mixed so far, although earlier tonnage estimates look to be close to where it will end up.

The speed of harvest, once growers were able to have a clear run with favourable weather conditions, has caught many out with storage filling up quickly and a scramble for trucks to get the grain out of paddocks. The extra area in crop this year has largely coincided with the regions that have performed best, and this has put extra pressure on harvest logistics. In some cases, logistical constraints have limited the speed of harvest more than crop performance.

Wheat grain quality has been mixed with some areas experiencing protein dilution due to the very high yields, other areas experiencing high screenings due to the lack of finishing rain and frost, and in contrast many in the low rainfall areas are harvesting paddocks with high yields and high protein. Falling numbers have been a problem in some areas where there were multiple rainfall events in late grain-fill, and at the start of harvest. The large variation in grain quality that became evident as harvest commenced and which was noted in last month’s Crop Report continues to be seen. Variation in grain size within paddocks has been a juggle for many growers, particularly in wheat in the central regions where there is a combination of frost affected crops and crops that have “pinched off” due to a lack of finishing rain.

Barley quality has been mostly very good with the higher-than-expected yields often being driven by larger seed size. Plenty of paddocks are making malt grades, hitting both protein and retention limits. Germ end stain has been a problem in many regions closer to the coast.

Milling oat tonnage will be well up on last year’s production and quality has been very good. In the low rainfall regions light weight grain has meant grain from some paddocks was undeliverable, although most paddocks have had a good combination of quality and yield.

Lupins have been yielding well everywhere after not “looking the goods” for most of the year, but that’s not unusual for lupins. Final tonnage is likely to be up on pre-harvest estimates. Pulse crops have also returned some very handy yields which will fuel enthusiasm into next year’s plantings.

Estimates of total tonnes have not changed significantly from November’s Crop Report three weeks ago.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate December 2025

Rainfall

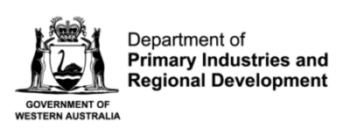

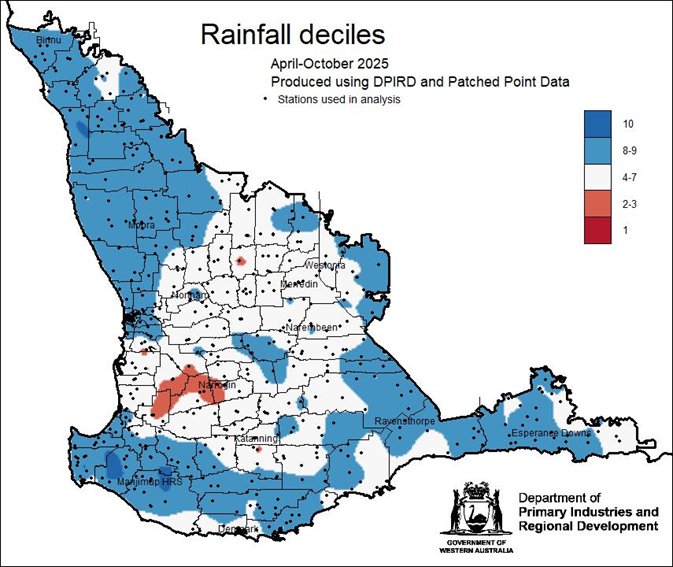

October rain was near average across most of the northern agricultural area, contrasting with drier conditions for southern areas and the South Coast. Rainfall totals since August remain above-average especially for northern and eastern cropping areas (Figure 1). Early November brought widespread rain, and some severe thunderstorms, to eastern and northeastern parts (Figure 2). Daytime temperatures have been near or above average, with relatively few occurrences of very high temperatures.

Forecast

Climate models continue to predict a weak La Niña event in the Pacific Ocean. There have been some signs of La Niña development since late September. A negative Indian Ocean Dipole event continues and is expected to decay in early summer. Historically, this can bring wetter conditions during spring over inland Australia, with relatively little impact over the southwest of WA.

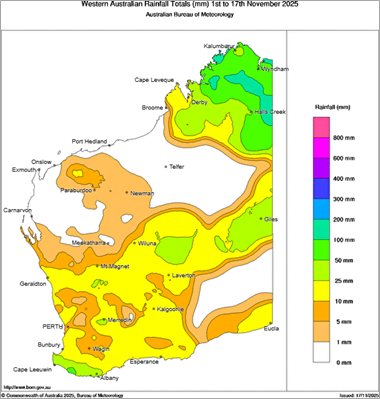

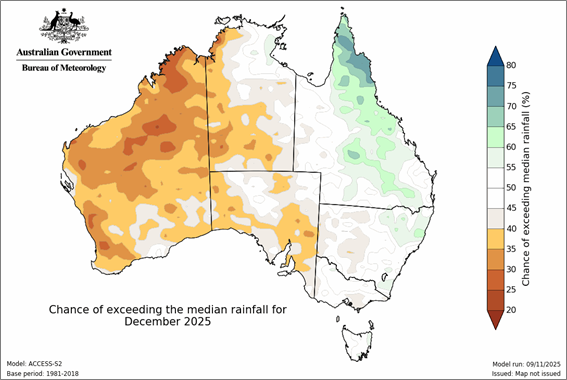

The Bureau of Meteorology’s seasonal outlook for December 2025 to February 2026 indicates that below-average rainfall is more likely over most of WA, with wetter conditions for parts of eastern Australia. December is expected to be drier than normal (Figure 3). Temperatures are predicted to be above average as well.

Figure 1: Rainfall deciles for April to October 2025, using years since 1975 as reference. Source: DPIRD.

Figure 2: Rainfall totals for 1-17 November 2025. Source: Bureau of Meteorology (2025).

Figure 3: Rainfall outlook for December 2025. Source: Bureau of Meteorology (2025)

Temperature

Daytime temperatures have been above normal in October, while nights have been cooler. Seasonal forecasts indicate that November and December are likely to be warmer than average, although the risk of extreme temperatures is only slightly elevated.

Additional information is available from:

- DPIRD: Weather stations

- DPIRD: Soil Water Tool

- DPIRD Rainfall to Date Tool

- BoM: Rainfall totals for growing season 2025

- BoM: Rainfall outlook for the next week

- BoM: Seasonal Rainfall Outlook

- BoM: Australian Water Outlook

Geraldton Zone

- Harvest is running 7–14 days behind normal.

- Wheat yields of 4–5 t/ha are common, which is 1.5–2.0 t/ha above long-term averages in the better areas.

- Canola yields are approaching 3 t/ha, which is 0.5–1.0 t/ha above the long-term average, and some are more than 1 t/ha above that average.

- Lupins are yielding over 2 t/ha, with the best paddocks up to 3.0–3.5 t/ha.

- Soil amelioration is reducing “poor patches” and is increasing higher whole-paddock averages.

Harvest in the Geraldton zone is significantly behind where it normally is, with growers still finishing off areas of canola that hung on and ripened late due to the mild finish. Barley and wheat have been harvested ahead of canola, which is highly unusual. Despite delays, crop performance has exceeded expectations with canola yields approaching 3 t/ha on well-ameliorated sandplain, while heavier coastal soils have been slightly lower due to intermittent moisture stress. Lupin yields are also tracking up to 3–3.5 t/ha in the better paddocks. Wheat is performing particularly well, often 1.5–2.0 t/ha above long-term averages.

The volume of grain still to be harvested is placing significant strain on receival site capacity. Many bins are full or reaching emergency storage limits, forcing growers to cart grain further to find space, and this situation is expected to intensify over the coming 10 days as wheat deliveries accelerate.

Kwinana Zone

Kwinana North Midlands

- Harvest is 7–10 days behind where it normally is due to cooler weather and periodic rain interruptions.

- Wheat yields are 0.5–1.0 t/ha above expectations with good test weight and screenings.

- Barley quality issues relate mostly to low protein and germ end stain.

- Canola is averaging 2.0–2.8 t/ha, with better areas achieving 2.8–2.9 t/ha.

- Lupins are yielding 2.5–3.0 t/ha with many still to be harvested.

- The lighter soils that normally yield poorly have held up exceptionally well with the mild finish.

- Increased header capacity has resulted in faster harvesting speed even with higher yields.

Harvest progress is behind normal due to cooler weather, intermittent rain and sporadic fire events, although the speed of harvest has recently picked up considerably. The majority of canola crops have been harvested, with excellent oil performance and yields ranging from around 2.0 t/ha in more waterlogged areas, through to 2.8–2.9 t/ha where conditions were ideal. Grain yields of all crops in the “Goldilocks zone” of not too wet and not too dry have been the highest ever.

Harvesting of lupins and barley is progressing well, with barley around 70 per cent complete and yielding 0.5–1.0 t/ha above pre-harvest estimates. Grain quality issues have primarily involved low protein and germ end stain. Maximus barley in particular is achieving exceptional grain size, benefiting from a mild finish that also propped up lighter-soil areas that would typically struggle later in season.

Wheat harvest is less advanced and is about 20–30 per cent complete. Some growers have not yet started. Yields are 0.5–1.0 t/ha up on pre-harvest estimates, with mostly sound test weights and manageable screenings except in isolated pockets where heat or frost have caused pinched grain on the sandier soils. Grain protein dilution due to the high yields has resulted in the majority of deliveries only making the lower quality grades. Harvest capacity has scaled up dramatically with larger machines operating at very high throughput, meaning site logistics not header capacity has become the limiting factor. Many growers expect harvest to extend into Christmas and the New Year as the remaining cereals come off under continued strong seasonal conditions.

Kwinana South

- Harvest is progressing well, with most growers expecting to finish before Christmas.

- There are no widespread sprouting or falling-number issues following the recent rains.

- Wheat is coming in at above long-term average yields in many areas.

- Grain quality is quite variable with high screenings and low grain weights common, although many deliveries have good protein and are hitting milling grades.

- The canola harvest is largely completed, and canola continues to deliver strong financial outcomes.

- Barley in the eastern areas is affected by frost resulting in reduced grain-fill.

Western areas are yielding closer to initial high expectations for all crops.Harvest has progressed well through the Kwinana South zone, with a number of smaller and higher-capacity programs now close to completion. Most growers are confident of finishing before Christmas, marking a relatively smooth end to the year. Recent rainfall has not yet resulted in any widespread sprouting or falling-number issues.

Wheat yields are performing above long-term averages in the better areas, though quality continues to be highly variable within and across paddocks. High screenings and lower grain weights remain the primary concern. This problem is widespread in the region and is having an impact on both yield and quality. The impact from frost and the dry grain-fill period is really showing up now as more wheat paddocks have been harvested, which is making it difficult to gain a clear picture of how things will finish up. The inconsistent grain quality profile is generating a wide spread of grade outcomes from individual paddocks.

Canola is largely completed and yields have been good, resulting in strong financial performance for this crop again this season. Barley, while still yielding well overall, has not reached earlier expectations in the eastern areas due to frost impacts during grain-fill. This improves progressively to the west, where yields have aligned more closely with pre-harvest potential.

Despite some frustrations with variability in wheat quality and frost-related barley reductions in parts of the zone, 2025 remains a better-than-average production year across Kwinana South, particularly when compared against growers’ long-term historical performance.

Kwinana North East

- Harvest is running 7–14 days behind normal and some growers may still be going into New Year, especially in the better areas north of Dalwallinu and east towards Bonnie Rock.

- Wheat grain weight is light and screenings are high. Protein is generally in the 11–11.5 per cent range.

- Barley is performing better than expected at 2.5-3.5t/ha in the eastern areas.

- Canola is variable.

- Growers are shifting rotations, increasing barley and canola area and reducing wheat.

Harvest in the Kwinana North-East zone remains well behind historically traditional timing, with some growers still harvesting canola and many yet to begin the bulk of their wheat. Barley yields are exceeding early expectations, while canola performance is variable and strongly influenced by soil type and early moisture. Wheat remains the biggest concern, with light grain weight and high screenings seen for the second consecutive season. Despite these issues, yields remain respectable and better than initially anticipated, though the financial returns are tight in the lower yielding regions due to lower grain prices.

Logistics remain manageable in the central zone due to overall lower tonnage, but eastern storage sites are filling and could require back-hauling grain to keep sites operating. Many growers continue to reflect on the season’s nutrition decisions and rainfall distribution, with consensus that subsoil moisture and timing of rain, not nitrogen rates, had the greatest influence on grain quality. With two subdued wheat seasons in a row, growers are reassessing rotations, with more barley and canola expected in 2026. While harvest completion before Christmas is still the aim, regions further north are likely to push well into the New Year.

Albany Zone

Albany West

- Harvest in western parts of the Albany zone has been slow due to the wet ground, cool conditions, and recurring moisture delays.

- Wheat remains mostly unharvested in the west of the zone, and some wheat in the east of the zone is disappointing due to frost and late tiller loss.

- Barley harvest is underway and early yields are good, averaging between 3.5–5.0 t/ha where paddocks were not overly affected by waterlogging.

- Canola yields are average to slightly above average despite the dry start earlier in the year.

- Waterlogging has caused 10–20 per cent crop loss in many paddocks.

- The structural shift occurring with more cropping and less livestock is increasing harvest pressure.

At this early stage in the harvest, it is looking more like a good year rather than a very good year for the region. However total production is likely to be the highest on record, mostly due to the extra area sown to crops as sheep exit the system.

Harvest progress in the western parts of the Albany port zone varies, with wet and mild conditions slowing operations, while the eastern areas are further advanced. Moisture has been remaining in the canopy overnight, delaying harvest start times even for desiccated canola. Some growers have only had around two weeks of solid harvesting time to date. Waterlogging effects are widespread, with 10–20 per cent of paddocks contributing little to yield, but with the remainder of the paddock generally yielding well, this is helping to maintain averages. Canola performance is average to slightly above expectations, while barley yields are strong in the eastern areas and are expected to remain solid provided waterlogged areas do not drag down final paddock averages.

Wheat is largely unharvested in the western areas. In the east where more crop has been harvested, results have been a bit disappointing due to frost and reduced grain number per head linked to the early dry spell. Grain quality issues such as falling numbers have emerged, and growers are shifting focus toward barley and canola as more reliable earners than wheat. Capacity constraints at receival sites are already emerging, with logistics expected to be a key challenge once harvesting of cereals is in full swing. Structural expansion of cropping across the region — up to 20 per cent more cropping area in recent years — continues to add pressure, meaning many growers anticipate harvest running well into Christmas or even the New Year.

Albany South

- Harvest is 70 per cent complete. West of the Albany Highway has been slow in that region and will still be going up until the New Year. In the east, most growers will take another 7-10 days to finish off harvest.

- Earlier sown crops were mature before regions much further north, which is unusual.

- Canola has been exceptional with the better paddocks in the 3.0-4.0 t/ha range and good oil percentages.

- Barley crops have been well above average on the early sown paddocks.

- A larger than normal grain yield difference between early and late sown paddocks is being seen for all crops.

Overall, temperature has trumped rainfall again. The impact on grain production in the region from the mild finish has pushed production to new highs, as it has in other areas of the state.

Canola is going to end up achieving the highest or second highest yields on record. The eastern regions are well above the highest on record, although further west towards Chester Pass/Albany Highway yields drop as the waterlogging inundation time lengthened.

North of the Ranges is the same, with the eastern areas performing better than the west, reflecting this season’s rainfall. Around Ongerup and further west, crops emerged later and had a difficult run, although most recovered remarkably to finish with average or just below average yields.

Barley is going to be the highest yield on record for the eastern areas and has performed well but not as well further west. Paddocks that are better drained are yielding over 6 t/ha, even in the lower yielding regions. Around Gairdner, some paddocks are going well into double figures. Canola yields North of the Ranges are going to be ranked within the top two years ever.

Apart from west of Albany Highway, the majority of barley should have been harvested a week from now.

Wheat, poor wheat! Most that have started harvesting wheat are experiencing sprouting or falling number issues, with falling numbers below 200 being quite common across the board.

A lot of wheat is still to be harvested and green heads from regrowth in the waterlogged patches will likely cause some delay.

Lupins have returned some very high yields, but paddock averages have been pulled down by the waterlogged areas. Yields will probably end up being ranked within the top four years, and if not for the waterlogged patches, would be the highest ever by a long way.

With only very limited hectares having yet been harvested, faba bean crops south of the Ranges are looking good and are yielding 3.0-3.7 t/ha. North of the Ranges, yields are highly variable with paddocks that germinated in April yielding 2.0-2.5 t/ha, while those that germinated in June are only yielding 0.5 t/ha. Faba beans have shown they are quite waterlogging tolerant and are finding a place in waterlogging prone areas.

Hay crops have had some massive yields with some reports of 10t/ha plus through the Katanning area.

The Albany South Coast areas have had a very good year for canola and barley and the grain yields coming in tell the story. The only dampener has been waterlogged areas dragging paddock averages down.

Wheat yields have not been as spectacular as canola and barley, as wheat crops were more exposed to variable time of emergence at the start of the season and this has had a big impact on final yields. The majority of wheat crops were also more impacted by the dry grain-fill conditions in spring.

Albany East (Lakes Region)

- Barley crops have been yielding above short-term averages with many in the 3.0-3.5 t/ha range, and grain quality is good.

- Canola crops have been averaging in the high 1.0 t/ha range, which is also above short-term averages.

- Wheat yields have been more variable as they were more impacted by frost and the dry finish.

- Oats have been very good with yields often above 3.0 t/ha and quality is good.

The region has had a very good year with an earlier start than areas further north setting crops up well initially. The region did not have particularly high rainfall totals, with most of the region in the 4-5 decile range, but where crops got away early they have done very well and this has resulted in very high-water use efficiencies.

Many crops were impacted by frost to some degree, which took the top off yields.

Esperance Zone

- 65–70 per cent of Esperance growers have finished harvesting.

- Wheat underperformed relative to expectations with very few crops exceeding 4.5 t/ha. Quality challenges include high screenings, low hectolitre weight, and low falling numbers in rain-affected areas.

- Barley yields are among the best on record.

- Canola yields are the best ever in many areas, with the majority above 2 t/ha, and the best areas 3.3–3.5 t/ha.

- Faba bean yields have been high, around 2 t/ha. Peas are yielding 1.8–2.5 t/ha, and lentils around 2 t/ha depending on frost impact.

- Growers are considering increasing canola and barley area at the expense of wheat, driven by performance and price signals.

Harvest in the Esperance port zone is entering the final stages, with around 70 per cent of growers now having finished. Canola outcomes are the clear highlight, with many growers reporting their best ever performance, with most paddocks exceeding 2 t/ha and large areas consistently achieving 3.3–3.5 t/ha.

Barley yields have also been outstanding, while wheat yields have been closer to recent averages rather than above average. Frost, soil-type variability and a dry September/October period capped wheat yield potential, leaving many crops below expectations even though absolute yields remain solid. Moisture-related quality issues such as screenings and low hectolitre weight have been evident in lighter soils.

Pulses have generally performed respectably, though frost-affected areas limited upper-end yields in peas and lentils. Logistics pressure has been present but manageable, with reduced on-farm storage reliance compared with previous very wet years. Falling numbers and sprouting have appeared locally but not as severely as further west. Overall sentiment is positive, with growers leaning toward increasing canola and barley area next year while reducing reliance on wheat due to both performance and current pricing signals.