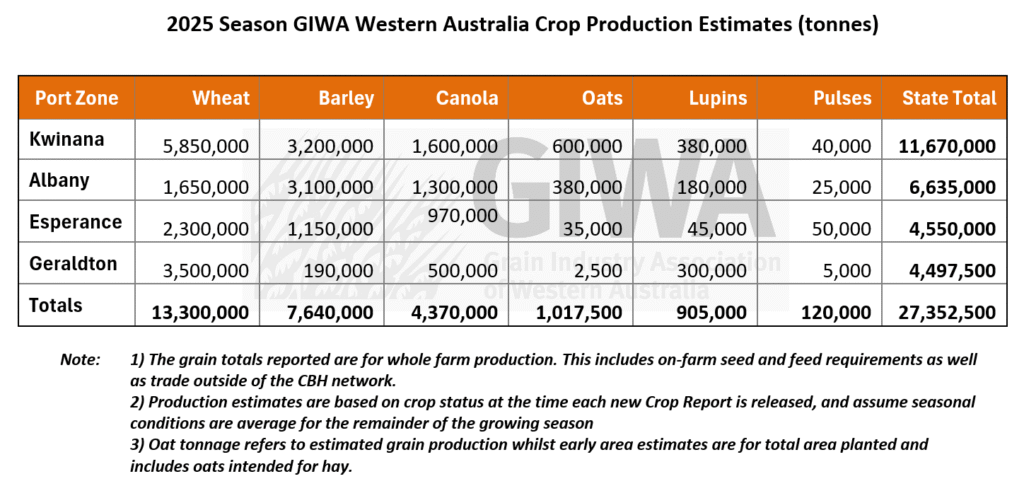

The 2025 Grain Season – Record production by 2 million tonnes

The 2025 grain growing season was again a record, the fourth in five years. This record production was fueled by exceptionally good yields in three of the five port zones and good yields across the other two. Adequate rainfall in July and August in most areas followed by mild temperatures during grain-fill allowed crops to push water use efficiency to very high levels.

An increase in total crop area of 6.8 per cent from the previous record production in 2022 helped considering most of this increase in areas was in the higher rainfall regions. Wheat area was down 3.3 per cent, canola was down 7.3 per cent, barley was up 26.4 per cent, lupins up 17.4 per cent and oats up 65.1 per cent (total oat area, including oats for hay).

Wheat crops in the central regions of the state suffered from a later start and less spring rain than further north and south, which resulted in yields being below previous record years and grain quality was erratic with both high screenings and low protein resulting in downgraded quality segregations. Grain quality for wheat was also erratic in the southern regions with low falling numbers, sprouting and low protein also resulting in downgrading.

Wheat crops across the state did not perform as well as barley for a range of reasons. Barley had a dream run for disease in 2025 and avoided most of the frost that shaved off over a million tonnes of wheat in the central regions of the state. Wheat also suffered more from grain quality issues where rainfall was light going into spring. The mild spring extended the grain fill period, and where moisture reserves were low going into spring, wheat crops failed to fill the many available grain fill sites fully. Conversely, this slow maturity period pushed grain yields for wheat to heights never seen before in areas that had adequate subsoil moisture, but where top growth was excessive driven by the warm wet early stages of spring, this extended mild finish resulted in wheat crops slowly transpiring themselves to death and resulted in significant yield loss from grain weight and then downgrading for quality.

Barley grain yields and quality in most regions were good although many growers opted for voluntary downgrades to Feed due to the low malt barley premiums and simpler logistics for delivery. Barley profitability exceeded wheat in many areas and on the back of this, an expansion in barley area is likely for the 2026 growing season.

Canola was again the most profitable crop for most areas in 2025 with the combination of above average grain yields and prices holding up giving a boost in returns for growers. The price premium for CAN (non-GM) over CAG (GM) at harvest and going into the 2026 season will see the slight substitution out of CAG to CAN that occurred in 2025 continuing in the southern regions in 2026, particularly as the yields for newer IMI (imidazolidine) and TT (Triazine) varieties are getting closer to the Roundup Ready® lines. The area sown to canola will go up this year if there is an early break to the season, particularly now that the recent rains from ex-cyclone Mitchell have delivered some subsoil moisture across significant areas of the grainbelt.

The lupin area in the state increased by 11.2 per cent from 2024 to 2025 pushing production over 900,000 tonnes for the first time in more than 15 years. Variable grain yields and the cap on price in Western Australia continue to hamper the crop and a reduction in area substituted to canola is likely for the 2026 season.

Oats has continued its push to becoming a substantial crop for growers in Western Australia with oats harvested for grain consistently sitting around 60 per cent of the planted area over the last four years, with the remainder going to hay. Both oat grain and oat hay reached production levels around 1 million tonnes in 2025 and whilst prices have come off from highs at the start of the 2025 growing season, they haven’t crashed as in the past. This maturing of the crop with diverse and growing markets coupled with growers having greater confidence in being able to reliably hit higher yields under a range of seasonal conditions will probably see the boom-and-bust cycles of the past, fade. However, saying this, early indications are that the crop area will contract in 2026 due to some questions around the sustained year-on-year growth putting a block on prices.

Pulse crops went well in most areas in 2025, although prices remain a major stumbling block for further substantial expansion. There are a raft of hurdles for all the pulse crops to overcome before there is likely to be any significant jump in areas in the future. The most promising is lentils based on 2025 yields across the state, whilst the areas planted to faba beans, field peas and chickpeas are all likely to stay stagnant in 2026.

For many growers in the better areas, operating margins were good due to relatively high yields, even though grain prices were down from previous years. Across the state, the total value of production was greater than the previous record year in 2022, although this was skewed to the perimeters of the grainbelt, with the central regions where crops were lower yielding recording significantly lower operating margins than 2022.

With these lower grain prices last harvest, small changes in farm gate return due to factors such as quality downgrading pushed the breakeven yields required to be profitable to historically high levels. Projected budgets for 2026 are tight for many, even though some of the main operating costs such as fertilizer and crop protection products have not spiked in price. Self-inflicted business costs such as machinery and land purchases are having a greater impact on budgets than some of the major variable costs.

In the past, tight budgets have resulted in growers pulling back and becoming more risk adverse, although this time round there is a quiet confidence among growers that they can now hit these higher yield levels required to maintain profit under a range of seasonal conditions based on recent history. In saying this, most growers are expecting that the good times can’t last and will be preserving capital rather than aiming to maximise profit. If the break of season is late in 2026, this may mean there will be more fallow in the lower rainfall regions, and not committing to the current planned areas of canola in the medium to low rainfall regions.

On the production front, overall sentiment is positive going into the 2026 growing season, but growers remain concerned about external factors affecting global trade to which Western Australia is heavily exposed.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate February 2026

Rainfall

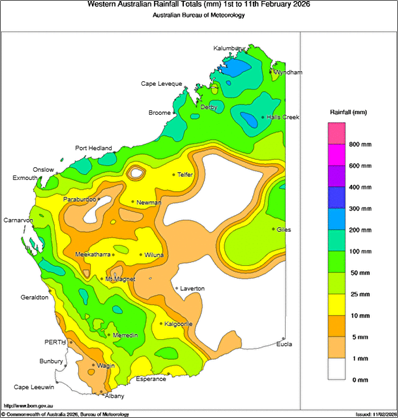

After a summer that had offered little rain to date, Tropical Cyclone (TC) Mitchell brought significant rain (and some wind damage) to much of the agricultural area apart from the Southwest (see Figure 1). Soil water stores are now above average in many areas. Daytime temperatures to date have been well above normal, with recent cooler conditions courtesy of TC Mitchell.

Forecast

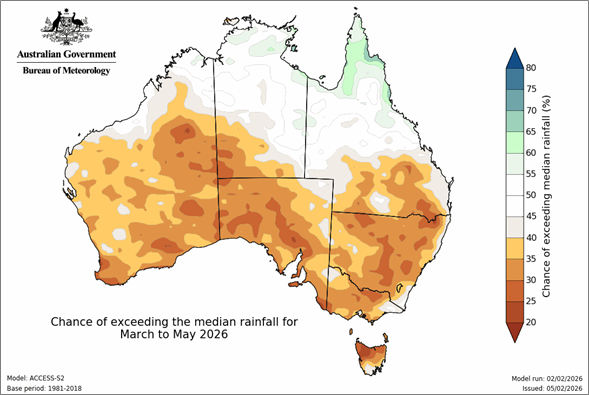

Climate models indicate a transition from current weak La Nina conditions to an El Nino event in the Pacific Ocean from about May. There is also some indication of a positive Indian Ocean Dipole event in 2026. Combined impact of concurrent events historically limits winter and spring rainfall over much of Australia. Forecasts of these events made in February have higher uncertainty, so developments should be monitored.

The Bureau of Meteorology’s seasonal outlook for March to May February 2026 is indicating below average rainfall being more likely for most of WA (see Figure 2). This continues into June and is likely driven by forecast higher than normal atmospheric pressure in the southern Indian Ocean and the Southern Ocean.

Figure 1: Rainfall totals for 1 -11 February 2026. Source: Bureau of Meteorology (2026).

Figure 2: Rainfall outlook for March to May 2026. Source: Bureau of Meteorology (2026)

Temperature

Daytime temperatures have been above normal for much of summer to date. Seasonal forecasts indicate March to June period is likely to be notably warmer than average, with elevated risk of extreme temperatures.

Additional information is available from:

- DPIRD: Weather stations

- DPIRD: Soil Water Tool

- DPIRD Rainfall to Date Tool

- BoM: Rainfall totals for northern wet season 2025/26

- BoM: Rainfall outlook for the next week

- BoM: Seasonal Rainfall Outlook

- BoM: Australian Water Outlook

Geraldton Zone

Late rainfall and a delayed harvest had a pronounced impact on grain quality and value, with test weights commonly falling from the low 80s into the mid-to-high 70s, equating to yield losses of 300–600 kg/ha. The cumulative impact of downgrading and some variability in sampling results at receival points stripped more value from grain than would have occurred in previous seasons. Break-crop decisions continue to diverge across the zone, with lupins remaining viable in southern and western areas, and canola returning higher margins further north and east. For 2026, programs are expected to remain flexible, with a shift back to fallow and reduced area planted rather than risk sowing crops with potentially marginal outcomes. A major theme emerging is structural adjustment through machinery strategy and technology adoption, including retaining and rebuilding older equipment, increasing harvest efficiency with larger header fronts, and accelerating uptake of precision spraying, automation and dual-tank spray systems to reduce costs and improve resistance management.

The Geraldton port zone delivered record tonnage in 2025, yet this production outcome masked a more challenging financial outcome. While operating margins were good, whole-business profitability is being constrained by rapidly rising non-agronomic costs. Crop protection inputs remain manageable and fertiliser prices, though high, were not unprecedented, but machinery, labour and other overheads are putting pressure on current budget estimates. Competition for skilled staff continues to push wages higher, while machinery costs remain elevated with little sign of easing. Recent widespread rainfall of 30–50 mm has significantly improved subsoil moisture, creating strong momentum for deep ripping, although staffing capacity is now the key limitation to implementation.

Kwinana Zone

Kwinana North Midlands

Grain quality across the region was generally excellent, however protein levels were poor, eroding value and pushing on-farm returns well below $300/t for wheat and similarly lower prices for barley. Despite some of the highest wheat yields seen locally (including whole-farm averages exceeding 5 t/ha), the season was ultimately described as little more than a marginal “money-changing exercise” once high costs, nitrogen losses, extra operations and post-harvest charges were accounted for. Recent rainfall was welcomed after an exceptionally dry lead-in, and 2026 planning is now being reworked toward increased barley and canola area. Operationally, large variability in barley quality sampling poses risk, while a strong push into drainage is underway to address clearly defined waterlogging zones. Precision agriculture and variable-rate management are viewed as key opportunities to lift performance on better soils, though there is concern that ongoing cost-driven reductions in nutrient replacement risk running down the most productive zones over time.

In contrast to some neighbouring regions, lupins continue to fit well within local systems and delivered good returns for growers last season, with profitability driven by yield rather than price. Pulse price volatility remains the central challenge, highlighted by the sharp fall in lentil prices from around $900–$925 twelve months ago to approximately $625–$650 currently. Lentil area is expected to increase only marginally, constrained by harvestability and paddock selection, with 2025 yields typically ranging from 1.4 to 2.1 t/ha. Many growers felt yield was left behind due to the learning curve associated with harvesting lentils, while sclerotinia is expected to cap further expansion in northern parts of the zone.

Kwinana South

Recent rainfall was patchy across the zone, with around 10 mm recorded in some districts and more intense storm strips to the south-west.

Overall, the 2025 season delivered average to above-average yields, but profitability remains highly questionable under current grain prices. Wheat crops in particular often appeared set up for strong outcomes, only to fall well short at harvest. The season effectively ran a month late, with an excellent August followed by a rapid shut-down from mid-September, leaving crops carrying large tiller numbers but poor grain fill. October performed more like a delayed September, and even without significant heat, the lack of follow-up rainfall resulted in widespread unfilled grain. Frost further compounded losses, particularly east of the Great Eastern Highway, tapering to the west. As a result, many paddocks finished 30–40 per cent below their apparent yield potential.

From a rotation perspective, yields that would have been considered acceptable a decade ago are no longer sufficient under today’s cost structure. Barley continues to gain ground relative to wheat, pushing further into traditionally wheat-dominant areas. Canola remained the standout performer by a clear margin last year, though many businesses are approaching their practical canola ceiling due to harvest speed and machinery constraints, particularly at scale. Cereals were largely break-even at best, while lupins again disappointed due to frost impacts and duplex soils limiting pod fill.

Looking ahead to 2026, margins are the tightest seen in recent history, with variable costs similar to recent years but grain prices no longer masking them. Machinery investment has emerged as the critical pressure point, with break-even yields in medium-to-low rainfall transition zones now sitting around 2.7–2.8 t/ha, leaving little tolerance for seasonal failure.

Kwinana North East

Recent storm activity delivered useful rainfall across the zone, with approximately 30 mm received over a 24-hour period and conditions improving markedly.

Reflecting on 2025, rainfall timing was again the dominant driver of performance: paddocks that received early April storms produced the best crops and were the only ones to generate meaningful profit, while most others largely trod water.

Looking to 2026, there is pressure to increase canola area, though this remains highly contingent on achieving an April break. Without it, poorer-performing or dirtier paddocks are likely to be pushed back or left fallow. Barley is expected to gain further ground after a surprisingly strong season, outperforming wheat in many cases, with variety dynamics on acid soils also influencing area shifts and potentially reducing oat hectares. Canola yields ranged from around 1.2–1.4 t/ha in lower rainfall areas up to approximately 2.2 t/ha in better strips, though harvestability remains a key constraint. Grain quality issues were most evident in unripped headlands and compacted zones, with lightweight grain and high screenings common. Strong early biomass did not guarantee profitability where stored soil moisture was insufficient, and in some cases ripping was associated with poorer grain quality despite higher yield potential.

Albany Zone

Albany West

The Albany west zone had a very good year in the end. Fears of average paddock yields being significantly impacted by waterlogging were less than expected and final paddock yields for all crops were at the upper end of the scale.

Breakeven crop yields are rising, although growers are now more confident that they can hit these based on their performance s in a range of growing seasons lately. Barley is once again returning to favour, following a couple of years where barley was being substituted into wheat. Barley grain yields in 2025 were in excess of 20 per cent higher than most wheat crops in the region, and at current prices, is more attractive than wheat. Consequently there is likely to be a decrease in wheat area and an increase in barley area in 2026.

The slight shift out of CAG canola to CAN is likely to increase in 2026 due to the better CAG varieties having improved grain yields and the CAG price premium returning greater potential profit.

Albany South

Despite barley performing well for the first time in several seasons, protein levels were widely described as very poor across the zone. Prior to November rainfall, many growers were on track to achieve malt grades, but subsequent rain events shifted outcomes and increased downgrading. In the absence of a local malt segregation, some growers elected to voluntarily downgrade grain, as the small price premium for malt did not justify long-distance freight. This highlighted the practical influence of logistics on realised value, beyond production alone.

Rotation trends continue to evolve, with wheat again giving ground to barley and canola area edging higher despite many businesses nearing their practical limit. The net increase in canola area is expected to be modest (less than 5 per cent), partly driven by land transitioning out of livestock and ongoing fence removal. Within canola, a pronounced shift back toward TT and Clearfield® systems is underway, driven by gross margin advantages as price spreads persist and yields converge with Roundup Ready® types. Faba beans and other pulses are expected to decline further, particularly where establishment is delayed beyond early May, and some recent oat adopters are likely to revert to barley. Overall, rotational decisions remain tightly linked to establishment risk, gross margin resilience and logistical realities rather than yield potential alone.

Albany East (Lakes Region)

The Lakes region had one of the best years on record in 2025. All crops were close to record yields and grain quality in most cases was good. The region did not suffer the tight finish experienced further north or as much weather damage as areas further south. The early start got crops away evenly and the rainfall in spring followed by mild grain fill temperatures scripted a near perfect season topped off by little frost damage.

Sheep continue to be substituted for crop and the area going into crop is likely to rise again in 2026. This is in contrast to the higher rainfall regions where most of this adjustment has already occurred.

Barley will dominate cereal plantings again in 2026 and the swing into oats that has occurred for both grain and hay will probably back off this year. The success of canola in 2025 with its contribution to profit has many growers considering more hectares this growing season, although this will be largely dependent on the timing of the break to the season even though most of the region received good falls of rain in the last few days to provide some subsoil moisture reserves for this growing season.

Esperance Zone

Seasonal outcomes in 2025 broadly mirrored those seen elsewhere, with wheat returning mixed results due to frost, screenings, grain weight loss following rainfall and pockets of falling number issues. While quality impacts were not as severe as reported in some other regions, downgrades to AWW and AUH2 were still evident. September–October rainfall was adequate but not exceptional, and spring conditions were not as soft as further north, limiting the ability of crops to fully express yield potential. Nevertheless, yields were generally solid, with canola and barley returning standout performances and pulses remaining respectable despite not fully matching expectations set earlier in the season.

For 2026, program planning is trending toward increased canola and barley area, with wheat remaining a core crop and pulse hectares easing slightly rather than collapsing. Risk management, rather than harvest capacity, is the dominant concern, particularly with larger areas of canola and barley maturing early and simultaneously in a region already exposed to hail and wind risk and rising insurance costs.

Management attention is increasingly focused on nutrient replacement following large crop removals, drainage investment to address persistent waterlogging, and tighter scrutiny of grain and seed contamination thresholds. Disease pressure, particularly powdery mildew in wheat, had a clear yield and quality impact in 2025, with trials showing significant benefits from proactive fungicide strategies. As a result, varietal shifts away from highly susceptible lines and greater emphasis on quality resilience are expected to accelerate.