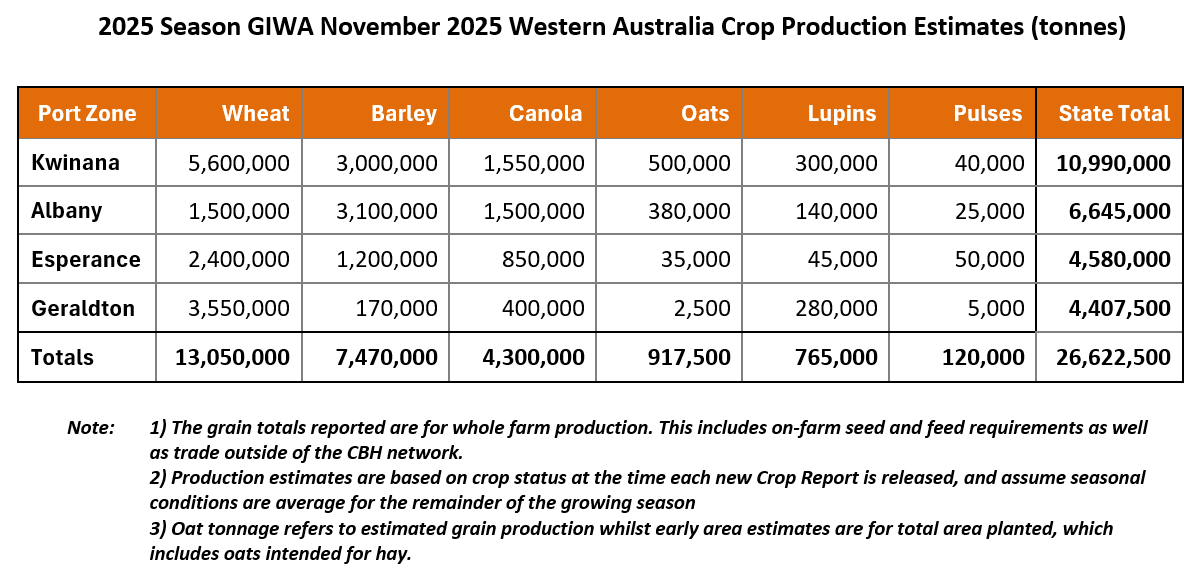

The mild finish to the growing season underpins another large Western Australian grain crop

Initial indications at the start of harvest are that crops are yielding more than expected and in many parts of the grain belt, are well above pre-harvest estimates. The mild temperatures in spring have pushed yields to record highs in those areas where moisture was not limiting and the areas where moisture was limited are still likely to hit recent averages.

Harvesting is further advanced in the Esperance and Geraldton port zones than the remainder of the state, and if the grain keeps coming in at the current rate both these zones are on track for record tonnages of total grain production of close to 4.5 million tonnes each.

Harvesting in the Albany port zone is well behind the other zones with less than 20 per cent of the crop off. Crops across the zone are estimated to achieve similar yields to those of the record year in 2022 where over 5 million tonnes was grown in the zone. Since then, the area in crop has increased by 20 per cent for many shires in the zone and based on this increase in area, it is likely the total production out of the Albany port zone will exceed 6 million tonnes this year. Harvest in the two Kwinana port zones has a long way to go and whilst current estimates indicate that it will be a good year, some areas have not fared as well as other parts of the state and consequently records are unlikely to be broken.

While the state’s harvest still has a long way to go, it is looking fairly certain that 2025 will be a record year for total grain tonnage produced in Western Australia.

Barley yields have been very good with plenty of 5t/ha paddock averages in all zones. Quality is also good with high retention and reasonable protein levels. Canola yields are better than expected everywhere, even in the central regions where the season was more patchy than other areas. Canola oil levels have been in the high 40’s for many paddocks, adding significant value to the crop.

Wheat has and will probably continue to be very mixed in quality across the state within and across zones. Even at this early stage of harvest, the spread in wheat quality grades across the major categories is relatively even rather than concentrated around the few premium grades as is usually the case. Wheat screenings are on the edge in many areas where the finish to the season was dry during the grain fill period. Protein dilution that occurs when grain yields are very high has not been as significant as expected, considering how high the paddock yields have been so far.

Oat grain yields have been good in most regions and the total tonnes produced will probably nudge 1 million for the first time since 2016 where there was a spike in plantings. In contrast to 2016, the oat area has been steadily pushing up in recent years and even though the tonnage has increased considerably, demand is still there from traders.

Lupin yields are mixed so far with some crops pushing everything into growth rather than grain. Pulse grain yields have been good again for faba beans, peas and lentils. Reports from growers who have put in trial paddocks of lentils in the central regions indicate they have gone reasonably well across a range of geographical regions and soil types.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Seasonal Climate November 2025

Rainfall

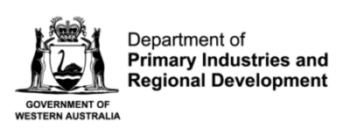

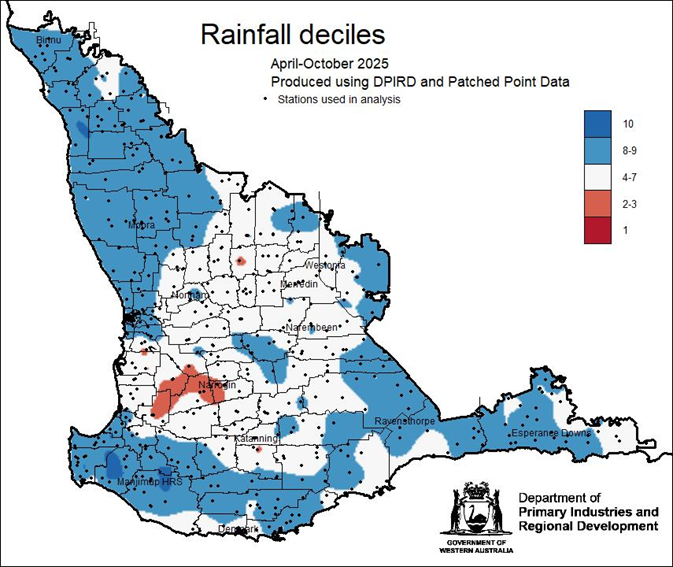

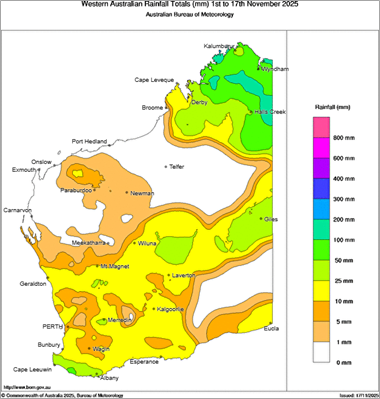

October rain was near average across most of the northern agricultural area, contrasting with drier conditions for southern areas and the South Coast. Rainfall totals since August remain above-average especially for northern and eastern cropping areas (Figure 1). Early November brought widespread rain, and some severe thunderstorms, to eastern and northeastern parts (Figure 2). Daytime temperatures have been near or above average, with relatively few occurrences of very high temperatures.

Forecast

Climate models continue to predict a weak La Niña event in the Pacific Ocean. There have been some signs of La Niña development since late September. A negative Indian Ocean Dipole event continues and is expected to decay in early summer. Historically, this can bring wetter conditions during spring over inland Australia, with relatively little impact over the southwest of WA.

The Bureau of Meteorology’s seasonal outlook for December 2025 to February 2026 indicates that below-average rainfall is more likely over most of WA, with wetter conditions for parts of eastern Australia. December is expected to be drier than normal (Figure 3). Temperatures are predicted to be above average as well.

Figure 1: Rainfall deciles for April to October 2025, using years since 1975 as reference. Source: DPIRD.

Figure 2: Rainfall totals for 1-17 November 2025. Source: Bureau of Meteorology (2025).

Figure 3: Rainfall outlook for December 2025. Source: Bureau of Meteorology (2025).

Temperature

Daytime temperatures have been above normal in October, while nights have been cooler. Seasonal forecasts indicate that November and December are likely to be warmer than average, although the risk of extreme temperatures is only slightly elevated.

Additional information is available from:

● BoM: Rainfall totals for growing season 2025

● BoM: Rainfall outlook for the next week

● BoM: Seasonal Rainfall Outlook

● BoM: Australian Water Outlook

Geraldton Zone

Harvest in the Geraldton port zone is behind where it normally is due to the later finish and resultant higher grain yields. About the only complaint anyone is having is that they may not be finished harvest before Christmas, which is of course is not really a problem to have.

Many growers are reporting “ridiculously high” yield monitor numbers, as is also the case in other port zones. Individual paddock averages are higher than they have ever been recorded previously. All regions of the zone are contributing their share of the grain. The percentage of crop area in wheat is historically high which is also contributing to the very high tonnages being delivered across the whole zone.

Barley is largely finished and having been sown early, typically yielded above 5 t/ha. Given the small price premium for malt, most growers in the zone are chasing yield and delivering their barley as feed, although some growers in the southern portions of the zone have been moving grain south to deliver into malt stacks if the economics work for them.

Canola is the standout crop in the region this year. Many paddocks are averaging around 3 t/ha in country where 2 t/ha has previously been the aspirational benchmark. Oils are outstanding, with 47–49 per cent common and 45 per cent now considered low. Oil bonuses of $50/t are typical, equating to an additional $100–150/ha in many paddocks. New hybrid canola varieties are dominating plantings and are expected to make up the bulk of the planted area again next season. June-emerged canola is delivering the best-ever yields, highlighting how a soft finish can outweigh later-than-ideal sowing dates.

Wheat is also performing extremely well, with plump, heavy grain and very low screenings of around 0.5–1 per cent.

Lupins are yielding reasonably well but at current prices are finding it difficult to compete financially with a 3 t/ha canola crop. Lupins destined for high-value human consumption markets in Europe continue to offer some premium opportunities, but growers are conscious that all pulses, especially lupins, must be economically viable to retain their place in rotations alongside increasingly profitable canola.

Lentils are showing strong promise on ameliorated sandplain, delivering around 2.5 t/ha on improved soils and around 1.5 t/ha on red country. Deep ripping, pH correction and flex-draper fronts are proving to be game changers for pulse production and harvest efficiency.

Kwinana Zone

Kwinana North Midlands

Harvest across the Midlands region is quite variable. Patchy rainfall events have benefited crops that were still filling grain over the last month, but waterlogging has impacted whole paddock averages in other areas. Areas east of Wongan Hills through to Ballidu and out onto the sandplain have produced exceptional results, with barley frequently yielding over 5 t/ha and some paddocks recording yield monitor peaks of 7–11 t/ha. Canola yields in these better areas are commonly in the -2.5 t/ha range, with isolated paddocks pushing towards 3 t/ha and oils in the 46–50 per cent range for the leading hybrid varieties.

In contrast, a large central strip between the Toodyay–Bindi Bindi Road and Rowes Road has been heavily affected by waterlogging, flooding and crop loss. Many paddocks in affected areas have 5–15 per cent of the area yielding zero, with the remainder yielding extremely well, resulting in diluted paddock averages of around 5.5–6 t/ha for barley and approximately 2.3 t/ha for canola, which while less than what might have been, are still good paddock averages.

Wheat is only just starting to come off in many parts of the zone but is expected to deliver mostly good quality grain, with some pockets of low hectolitre weight and screenings where hot conditions coincided with lighter soil types. Waterlogging impacts have renewed grower interest in surface and subsurface drainage to reduce yield variability within paddocks. Overall, where crops escaped waterlogging, this is one of the best-performing seasons on record in the North Midlands.

Lentils are generally yielding 2.2–2.8 t/ha, although lighter sands and paddocks hit by intense 20 mm rain events have seen reduced recoverable grain and higher harvest losses.

Kwinana South

Harvest progress in the Kwinana South region is mixed, with canola performing above expectations despite early concerns about spring frost and the dry June–July period. Canola yields are generally good, ranging from the low- to-mid 1 t/ha range on weaker country to well over 2 t/ha on better soils. Canola remains the standout crop in the region so far. Canola crops remained green for a long period and ripened slowly, which caused some logistical challenges as growers juggled their canola and barley harvesting, but this long grain fill period has contributed to higher grain yields.

Barley has also been solid, though not exceptional, with most yields in the high-2t/ha to mid-3t/ha and higher rainfall pockets reaching 4–4.5 t/ha. Frost has commonly removed 0.5–1 t/ha from barley yield potential, and many heads are partially or fully blank in the more affected areas. Overall, barley is being viewed as “good but not great,” with grain quality generally acceptable.

Wheat is the major concern for the zone. A combination of dry spring conditions and frost has resulted in poor grain fill and low hectolitre weights in the eastern parts of the region. Screenings are commonly in the 3–4 per cent range and increase up to 10 per cent in the worst-affected paddocks. The eastern corridor from Corrigin through Narembeen to Merredin is the worst affected, but the northern areas that got more rain are performing better.

Kwinana North East

Seasonal outcomes across the Kwinana North East region are extremely variable and largely dictated by where the early storms fell. Areas that received early moisture such as Dalwallinu to Beacon, Wubin, North Mukinbudin, Bonnie Rock and parts of the Yilgarn are achieving above average canola and barley yields, with canola often in the 2.0–2.5 t/ha range and barley in the 3.5–4.0 t/ha range, with some paddocks exceeding 4 t/ha. Oats have been a highlight, with many crops making Oat 1 grade and yielding more than 3 t/ha.

Outside the strips where the early rain fell, yields fall away sharply. Late-germinating canola and lupins have struggled, commonly yielding only 1.2–1.5 t/ha, with pod abortion, burnt flowers and poor finishing conditions limiting grain set.

Wheat grain quality is the major issue across the zone. Many crops that missed early storms are producing lightweight grain with hectolitre weights in the 70–76 kg/hl range, screenings between 10–20 per cent and protein levels between 10–14 per cent. However, away from these poor areas in the northern part of the region, crops are generally close to or above recent averages.

Many growers are prioritising harvesting their noodle wheat ahead of contract close, relying on pod-shatter tolerant canola varieties to stand in the paddock where necessary. Margins for growers are likely to be positive for most across their whole programs, but there is a strong sense that “one more rain” at the right time would have transformed the season in the drier parts of the zone.

Albany Zone

Albany West

Harvest across the western parts of the Albany port zone is significantly delayed. Some growers have only just started harvesting canola and very few are into cereals. A rain event 7–10 days ago and a very soft, prolonged finish have slowed ripening and pushed timelines back, and recent rain is creating additional delays.

Early canola yields are good to above average, although the very wet conditions have removed some of the top-end potential by causing lodging and flower loss during a six-week wet period. In the more open country in the east of the region yields improve markedly, with many growers reporting some of the best canola they have ever harvested. Even traditionally drier areas recovered well, and growers are seeing around 2 t/ha averages despite a poor start.

Cereal harvest is only just beginning in pockets, but early signs suggest good yields and minimal frost impact across most of the zone, other than some small patches in low lying areas. Waterlogging is going to have more impact on whole paddock averages than it did in the record year of 2022.

Albany South

The Albany South coastal and high-rainfall areas are having an exceptional canola and barley year. Canola has been going over 2.5t/ha, and in the better high-rainfall country canola paddocks are often yielding 4.5–5 t/ha in the better portions of paddocks, with wet patches pulling paddock averages back to around 3–3.5 t/ha. Oils are generally very good, and where growers avoided swathing or desiccating too early, both oil and yield are excellent.

Barley harvest has only just commenced, but early harvested paddocks are yielding around 5 t/ha, which is around 1 t/ha above long-term averages. Disease levels have been lower than expected, with limited sclerotinia despite earlier concerns, likely due to a drier September offsetting higher minimum temperatures.

Snail pressure has been patchy and generally low, with timing of baiting more important than product choice. Wheat is the main uncertainty in the zone. Head counts are high but grains per head are down compared to long-term averages due to the long, dry establishment phase and moisture stress during grain set and fill.

Overall, canola and barley are expected to finish significantly better than 2024, while wheat yields and quality is likely to be more variable and environment dependent.

Albany East (Lakes Region)

Grain yields are well above what was expected prior to harvest across the zone. Acknowledging that growers do tend to harvest their best paddocks first, the higher-than-expected yields are across all crops in most areas. The grain quality and in particular grain protein in barley is holding up under these high yields which gives some confidence that fertiliser management strategies have fitted the season. This increase in sophistication and willingness to take the risk is resulting in more opportunity to pick up on the upside of years like this.

There is a small amount of frost impact in the low-lying areas of paddocks in both barley and canola, dropping paddock averages, although much of the canola is averaging 1.8t/ha which is very good. Barley is similar with plenty of 4t/ha crops around, with most averaging 3.0-3.2t/ha which is a very good result for the region.

Oat crops are generally going 3.0t/ha and making weight to hit Oat 1 and Oat 2. The price has come off closer to harvest as expected, although even with the price below feed barley, it is still an important part of grower rotations in the region.

In the southern and eastern portions of the region bordering on the Esperance and Albany west port zones, grain yields increase to a point in some areas where it is the best year ever for those growers.

Esperance Zone

Harvest across the Esperance region is well advanced, with most growers around halfway through, although progress has been slower on the eastern side of the port zone due to later harvest start times during the day. Canola has been exceptional and is being described as the best on record in many districts, with large areas averaging above 3 t/ha and some better country in the 3–3.8 t/ha range. Clearfield® types are the standout, with Roundup Ready™ and TT systems also performing well. Oils are mostly in the 42–46 per cent range. Even in traditionally tougher Mallee environments, canola yields have approached 3 t/ha, although wetter coastal zones have recorded lower outcomes where waterlogging has been more severe.

Barley is also performing very well, with many crops yielding 5 t/ha or more and some up to 6 t/ha. Malt quality has been mixed, with lighter hectolitre weights in some varieties, but the strong yield base is supporting solid gross margins. Wheat yields are good but variable, ranging from 6 t/ha on the best ground to 3–4 t/ha elsewhere, with frost being the main factor pulling averages back in parts of the zone. Screening issues (5–7 per cent) and some ASW grades have emerged where nitrogen inputs were insufficient for the season’s yield potential.

Pulses have generally performed well. Lentils are mostly in the 1.8–2.5 t/ha range, peas up to 2.5 t/ha but slightly below visual expectations, and lupins are returning good yields except where waterlogged. Harvest challenges include snails, screenings and the growing concern about rain impacts on wheat quality as more showers lick through the region.