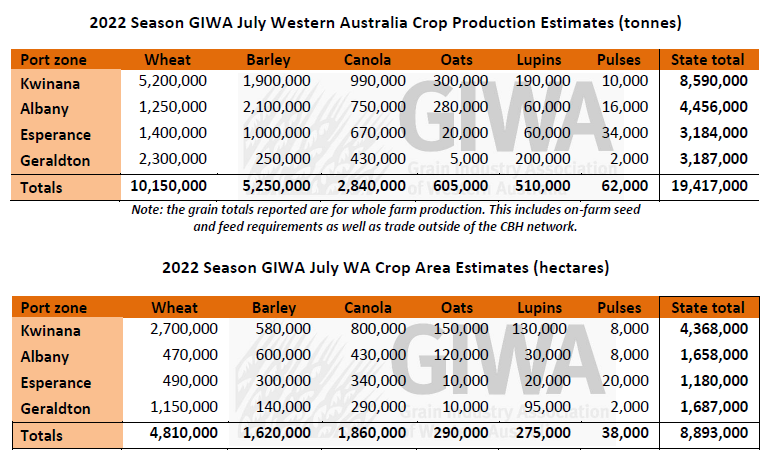

The 2022 Grain Season – Off the scale crop growth rates

The unprecedented warm conditions in June have pushed crops along to be at growth stages well ahead of where they would normally be at this time of the year. Crops generally look better than last year in many of the southern regions due to the advanced development. Crops are in very good shape in the southern regions although the northern regions are getting desperate for a drink and rainfall in the next week will be crucial in maintaining current grain yield potential. Climate models have suggested for a while the 2022 winter and spring in Western Australia will be drier than average and this is still the case.

June 2022 was one of the warmest Junes for many grain growing regions in the last 30 years and accumulated day degrees, which is the measure for winter crop development in Western Australia, for the same time period was nearly 8 per cent higher this year than last year. Most regions are sitting on very low deciles for soil moisture, in part due to the rapid crop development but also due to below average growing season rainfall.

The areas that were dry last month are still dry, although the majority of crops currently have average or above average grain yield potential. Most growers are well into their post sowing management operations, and many will be finished in a couple of weeks except for late insect and fungicide operations. This includes areas in the southern grain growing regions which is very much earlier than normal.

The recent grain price fluctuations and dryer predictions for spring have many growers on edge, particularly north of the Great Eastern Highway where sub-soil moisture reserves are running low. A lot has been invested in maximising potential yield across the state and whilst the current condition of the WA crop has many positives, there are plenty of red flags as well.

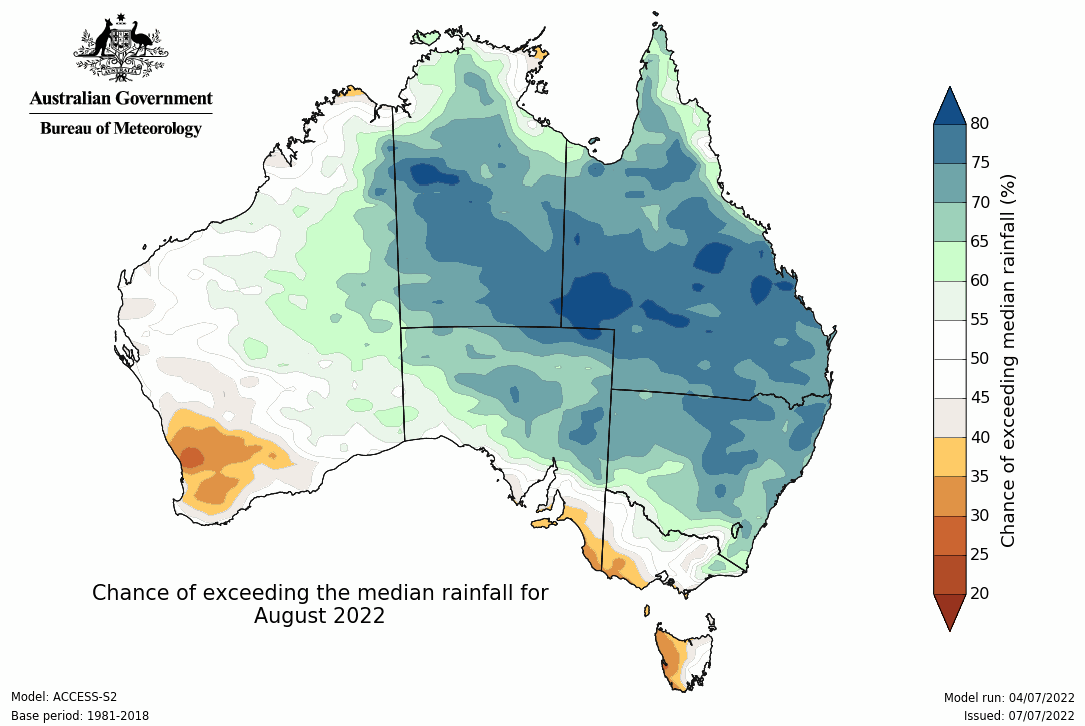

The warm conditions have bulked up crops and this “top” is running the moisture reserves down at a time when we need them to be building up for the inevitable warm temperatures to come. On the other hand, the advanced development stages of most crops mean there will be less spring rain needed to finish grain-fill. The looming risk is of course frost, and many crops are going to be exposed to a greater period of frost risk than normal. The predicted drier than average July and August mean clear skies rather than cloud cover which acts as a blanket for low temperatures.

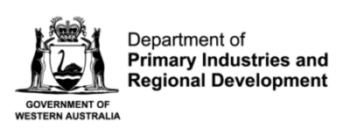

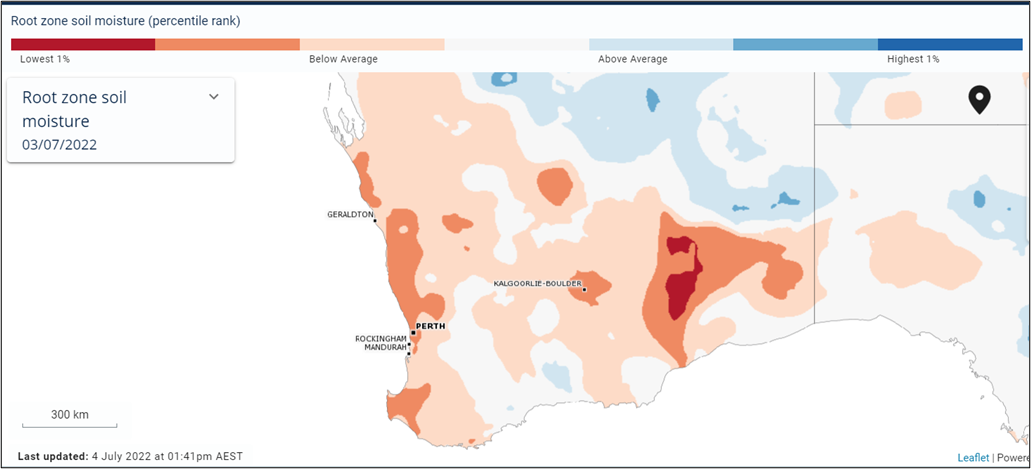

The current potential tonnage for all grain in WA is still around the 20 million mark as historically, there is the second largest crop in the ground, and it is in mostly good condition. Although the variance could be much wider than previous years due to the risk of low rainfall in the north and frost in the south. The downside could be quite significant if the predicted low rainfall spring eventuates. Although if crops in the north receive top-up rain in July and August, and the southern regions escape the frost, current potential tonnage estimates could hold up.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Climate Summary

June rain has been below average for much of the northern, central and parts of the southern cropping areas, as well as for the past three months. Combined with warmer than normal daytime temperatures and stronger winds, this has resulted in below average estimated root-zone soil water, see Figure 1. Parts of the South Coast retain above average soil water storage from rain in April and May.

In this context, rain events during July will be important in providing water for crops. Total rain for July is expected to be below average over the cropping area. Climate models are indicating improving seasonal rainfall for southern WA from August onwards.

Climate conditions in the Pacific Ocean show the La Niña event has ended, although there is a chance of another La Niña developing late in the year. In the Indian Ocean, most models are predicting the development of a negative Indian Ocean Dipole (IOD) event from winter. While this promotes rainfall over inland and eastern Australia it has a weak impact on southern WA. Oceans are warmer than normal around Australia, which can increase rain rates if weather systems can access it.

Most climate models retain neutral or perhaps wetter rainfall outlooks for July to September 2022 for the agricultural area of WA, although the BoM model has a drier outlook. Daytime temperatures are expected to remain above average.

Bureau of Meteorology seasonal outlook summary, issued 30 June 2022:

- July to September rainfall is likely to be above median for northern, central and eastern Australia, but below median for western Tasmania and scattered parts of western WA.

- July to September maximum temperatures are likely to be above median for northern, south-western and far south-eastern parts of Australia, but below median for parts of central and eastern Australia.

- Minimum temperatures for July to September are likely to be warmer than median for almost all of Australia.

- The likely development of a negative Indian Ocean Dipole, neutral El Niño–Southern Oscillation during winter, and warmer than average waters around northern Australia are likely to be influencing this outlook.

Additional information is available from:

DPIRD: Seasonal Climate Information

BoM: Seasonal Rainfall Outlook - weeks, months and seasons

BoM: Decile rainfall for April to June 2022

Figure 1. Estimated root-zone soil water deciles at 3 July 2022. From BoM Australian Water Outlook.

Figure 2. Chances of exceeding median rainfall for August 2022. From Bureau of Meteorology.

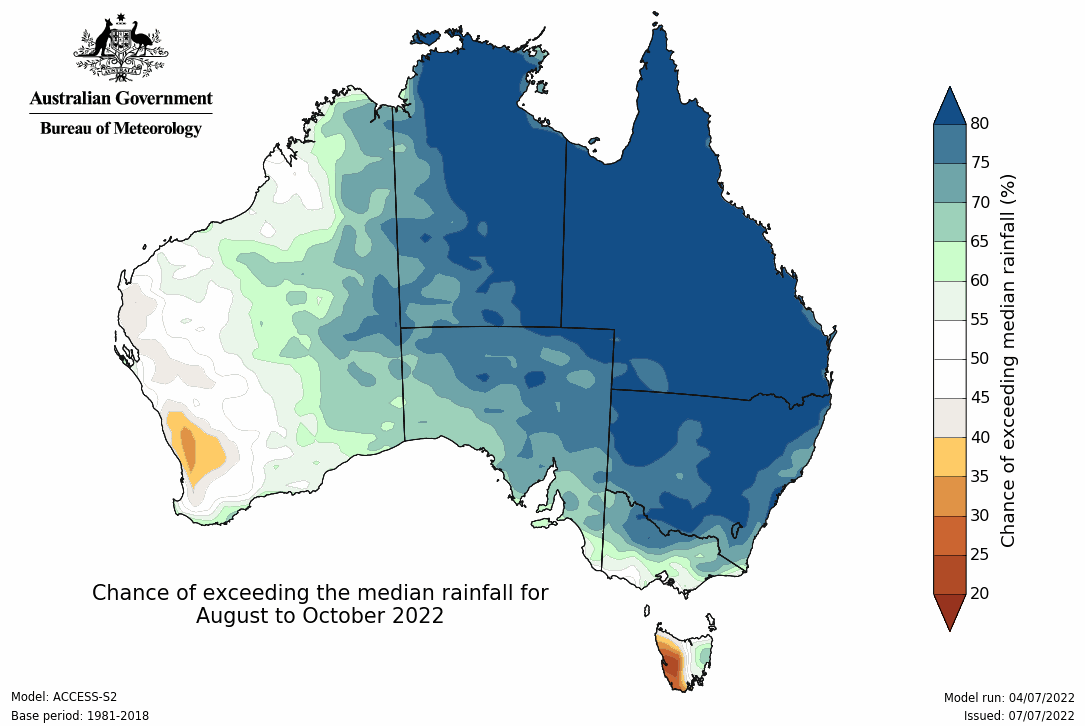

Figure 3. Chances of exceeding median rainfall for August to October 2022. From Bureau of Meteorology.

Geraldton Zone

The very windy conditions in the region over the last few weeks have dried things out and stressed cereals to a stage where some are starting to drop older leaves. The soil moisture profiles are very dry for this time of the year and most of the region is in desperate need of a decent rain. Potential total grain production in the zone is still at the upper end although a drier than average July and August will see a slide in potential to a point where any September rain received will be too late for grain fill.

In the eastern regions there are some very good patches of crop on the heavy country that managed to pick up a few extra storms. It does however tail off as you move south towards the Midlands where some crops have struggled to emerge fully.

Most crops are two to three weeks ahead of where they would normally be, and this could be the saving grace for many if the predicted dry continues. There is a bit of a spread in crop growth stages with everything from canola podding, lupins at big bud and cereals running up, to some still at 4 to 5 leaf. This spread in growth stages will to some extent buffer the region from a massive slide in potential tonnage if the next month or two is dry and the rain picks up in the spring as predicted.

Kwinana Zone

Kwinana North Midlands

Recent windy conditions have caused havoc in the North Midlands region with crop water use going through the roof due to the large top growth needing to be supported by very high transpiration levels usually only seen in the spring. Yield potential has dropped off a little in the last few weeks although most crops are still on track for an above average year. The exception is areas to the east that missed out on early rains, particularly around Latham and Wubin where time is running out for crops to recover.

A lot of nitrogen has gone out irrespective of the price due to the very good start, and more is going out in anticipation of a rain on the weekend. The majority of crop protection operations in the cereals have been wound up, one of the earliest finishes for many in the region. It’s looking like a big year for sclerotinia in canola and diamondback moth (DBM) are showing up, as they are in the Geraldton port zone. Both favour warm conditions and point to an early warning for canola crops further south.

Kwinana South

Crops further south, bordering the North Midlands region are in excellent condition, particularly south of Wongan Hills where the early rains and early sowing have crops bulked up and currently on track for above average yields. The western portions of the zone have picked up from the later start and have higher levels of soil moisture reserves than regions further east.

Crop growth has been phenomenal in June and has pushed crop development into a higher risk of frost damage than is ideal. In eastern areas of the zone where stored soil moisture levels are low, the advanced stage of most crops mean they may potentially be better placed to escape serious frost damage at grain fill. Areas around Tammin and further south had some heavy storms in June and soil moisture reserves for some of these growers are now greater than in 2021.

Kwinana North East

The lower rainfall regions in the North East Kwinana zone range from very good in the western areas, to tailing off dramatically in the far east. Areas southeast of Merredin that received the good early rains look exceptional and currently have above average grain yield potential. The crops north of Merredin and in a line northwest to south of Dalwallinu are early and barring major frost events are set up for average to above average grain yields. As per usual, the yield potential drops off in the northern and eastern fringes of the zone, although current crop growth stages put most ahead of significant heat stress periods in the spring.

The region has a much greater area of canola than has previously been sown and most have potential yields of more than 1.2 to 1.5 tonnes per hectare. The challenge for these growers is sticking to a plan of protecting the crop right through to the end, particularly with late insect infections that can take the top off grain yields in a short period of time.

Albany Zone

Albany West

The Western Albany zone is looking better than last year with crop growth across whole paddocks very even in contrast to last year, where the wet areas were very evident. Crop development is well advanced with canola in full flower, a full two weeks earlier than in any previous year. Some of the barley is at 1st node. The wheat is also looking good and even though the growth has been exceptional, it is behind the barley which could be a good thing coming into spring.

Growers are topping up with nitrogen ahead of the rain anticipated this coming weekend. The majority of the crop protection activities will be over in a couple of weeks, well ahead of normal.

Many growers have commented that the crop growth has been too quick and are worried about the outcome if it is a frosty spring.

Albany South

The Southern Albany zone is in excellent shape along with most of the state’s southern regions. The crops went in early and growth rates have been very quick. There is not the waterlogging of last year and all crops have plenty of biomass which means high potential grain yields are on the cards.

The Albany Port Zone is the one region of the state that could come close to the record tonnage of 2021 if growing conditions hold up through spring.

Albany East (Lakes Region)

At present, crops in the Lakes Region look better than last year. This is partly due to the high growth rates in June and lack of waterlogging in some areas last year. Most of the region has had between 150 to 200mm of growing season rainfall and will only need average July and August rainfall to reach above average grain yields. Fertiliser rates have been good, and this has contributed to the excellent crop health across the region.

Frost is the only real threat on the horizon for the area. The predicted drier than average spring generally means clear skies and greater risk of frost. Crops this year will be exposed to a longer frost risk period than normal. Whilst this is a worry, there is not much anyone could have done about it as the usual frost mitigation strategies, such as staggered plantings, were put in place by growers in the region. The crops are very advanced for early July with canola bolting to early flower. The barley looks very good, as does the wheat.

Interestingly, the Maximus® barley is showing up with more spot type net blotch (STNB) than in previous years and this observation is the same for other areas of the state.

Esperance Zone

The Esperance Port Zone is a bit of a mixed bag with some areas around Cascades still needing to dry out, and the dry areas around Wittenoom Hills needing more rain. Areas to the east towards Beaumont are very good whilst further north closer to “The Gums” are dry. The western portions of the zone are very good again this year and the coastal regions are not under water as they often are during winter. The last two weeks have been dry, and most growers are looking forward to the forecast rain this weekend.

Overall, the zone at present probably does not have the potential to nudge the record tonnage of 2021 due to the variable condition of the crop across the whole zone. There are some very early crops that are in good shape although most growers are a bit nervous at how advanced they are for this time of the year.

Some of the canola is starting to pod up and the early sown cereals are running up already. Cereal leaf diseases and insects have come in earlier than normal. Growers have not backed off on inputs with plenty of nitrogen going out on cereals and canola to ensure grain yield is not limited.