The 2022 Grain Season – Another near record season likely

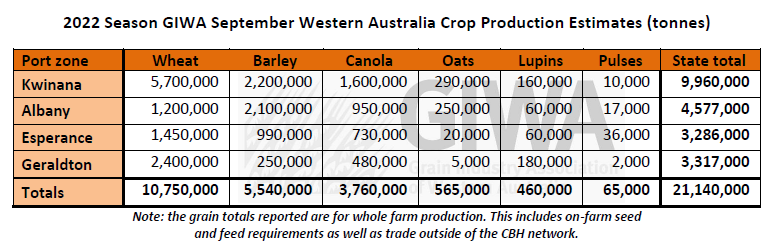

Good falls of rain for much of the grainbelt over the last week have kept crops on track for another near record year for Western Australia. Total grain production for the state will almost certainly exceed 20 million tonnes and potentially nudge last year’s total of just under 24 million tonnes. Frost and possibly a blast of heat are the only obstacles on the horizon. Crop growth has slowed down in the last month from the cold temperatures, and most are now at about “normal” growth stages for the time of sowing rather than a week or two more advanced than has been the case for most of the year.

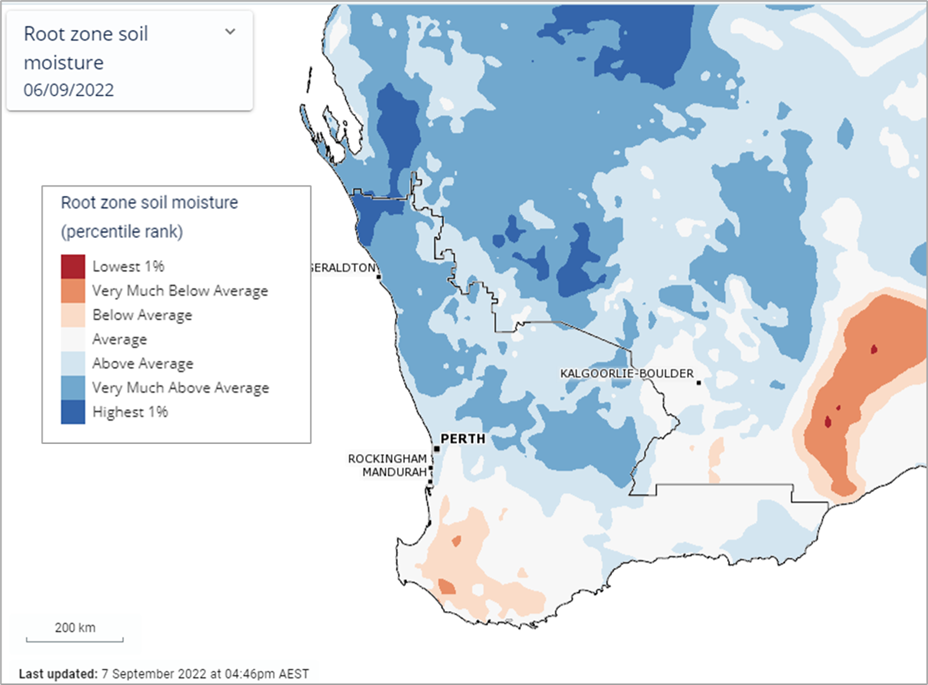

For many regions, crop development timing will now coincide with the frost risk period through September and early October. This risk will be lessened if the front predicted to arrive early next week eventuates and gives crops another few days of reprieve. Crops have also put on more “bulk” following the rainfall in August and this extra “top” may push crops into a greater risk of heat shock from hot winds during grainfill.

Even though the top end potential across the state for most regions is not as good as last year, the current total grain production potential is on par with 2021 due to less area waterlogged and more stored subsoil moisture across the state available to finish crops. The big kicker is the large areas of the eastern grainbelt where there are no poor pockets of low rainfall as there was last year. The inevitable impact from frost and heat will largely determine the final outcome.

Cereal crops are generally underdone for nitrogen, and this will impact on grain yields and protein levels, with most growers expecting a higher percentage than normal of their grain being delivered to the lower grades at harvest. The high grain yields and corresponding high nitrogen extraction by crops in2021, have been followed by high nitrogen prices in and a bearish outlook for rainfall early in this growing season which combined to reduce nitrogen use this year. This has potentially resulted in a lot of “grain left in the paddock” as a consequence of being under fertilised.

It has been a costly year to grow grain and whilst the expected high tonnage will offset the lower grain prices on offer leading into harvest, growers are already planning for a reduced area planted next year, when they will be more exposed to the projected high input costs.

Highlights from the season to date include an incredible recovery from the very dry start, particularly in the northern regions of the state, the general increase in bulk of all crops once the rain got going in the second half of July, the podding up in the lupin crops, and the excellent management of canola crops in the low rainfall regions where many had not grown the crop for up to 10 years. Whilst the season has gone our way in the last seven weeks, the overall management by growers has had a very positive impact on the potential of the crop.

Seasonal Outlook

Ian Foster, Department of Primary Industries and Regional Development

Climate summary

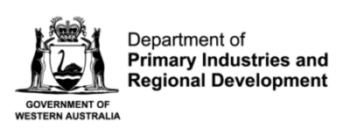

August rain was well above average across much of the agricultural area, thanks in part to a cloud band over 16 to 17 August 2022. Soil water storage is now well above average over much of the cropping region (refer Figure 1).

Temperatures were below average for August, with some frosts occurring mostly in central and eastern cropping areas (see Figure 2).

Most climate models show neutral rainfall outlooks for September to November 2022 for the agricultural area of WA, although the BoM model has a drier outlook for the southwest. September rainfall is predicted to be more likely below normal across the southwest, although good rain in the first week has seen northern and eastern cropping areas achieving average already. Night-time temperatures in September are expected to be near normal or slightly warmer, with frost risk also normal.

Bureau of Meteorology seasonal outlook summary, issued 1 September 2022:

- September to November rainfall is likely to be above median for the eastern two-thirds of Australia, but below median for south western Tasmania and southwest Western Australia.

- September rainfall is likely to be above median for much of Australia, with the chance of above median rainfall more widespread in September than later in the season.

- September to November maximum temperatures are likely to be above median for the tropics, southwest Western Australia, and Tasmania; cooler than median days are likely across much of the rest of Australia.

- Minimum temperatures are generally likely to be warmer than median for September to November over much of Australia, although there is roughly equal likelihood of warmer or cooler nights through much of central to southern Western Australia and western South Australia.

- The negative Indian Ocean Dipole event, increasing chance of La Niña emerging during spring, positive Southern Annular Mode index, and warmer than average waters around northern Australia are likely to be influencing this outlook.

Additional information is available from:

DPIRD: Seasonal Climate Information

BoM: Decile rainfall for April to August 2022

BoM: Rainfall outlook for the next week

BoM: Seasonal Rainfall Outlook

Figure 1. Estimated root-zone soil water deciles at 7 September 2022. From BoM Australian Water Outlook.

Figure 2. Number of days with minimum temperature of 20C or less. From DPIRD and BoM observations.

Geraldton Zone

The Geraldton port zone will be the only region of the state unlikely to match last years tonnage. The 4 million tonnes of total grain produced in 2021 was the result of a very good growing season and nearly complete lack of heat shock in the spring. The crop this year is still very good, although a lot of potential grain yield was lost earlier on due to the long dry spell. The lost biomass in the shorter growing season in the north has not allowed the crops to regain the potential that was lost, as it has further south in the state.

The rain in August and now in September will add grain weight but not much more. The large areas of ameliorated soils in the region will buffer those crops from the heat to come. Combined with some soil moisture reserves and being less frost risk prone due to their advanced growth stage, crops in the zone are very likely to achieve the estimates in this report.

Kwinana Zone

Kwinana North Midlands

The region is on track for a result that could rival 2016 and 2018, which were record years for the region. The region is currently in better shape than 2021, which was also a very good year, with less areas affected by waterlogging and more subsoil moisture. One more reasonable rain next week will nearly mean you could almost shut the gate on the season.

The crops are not as bulky as 2021 although the potential is there. September rain in the northern half of the state means gold for the area and one more rain will be the icing on the cake.

It has been a busy year with sclerotinia in canola cranking up early due to the warm first half of winter. Blackleg in the older open-pollenated varieties has also been rife this year. Leaf disease control in both wheat and barley has been ongoing, with many wheat crops now also needing a head wash for powdery mildew.

Mice control has been ongoing, and most growers are baiting to put a lid on numbers going into spring.

Kwinana South

The South Kwinana region has continued to improve over the last month. The regular rain and cooler temperatures have improved the outlook considerably from the scratchy, latish start. The wet areas that started to show up in August in the profile will not have a significant impact on the final grain production across paddocks due to the excellent crop growth easily accounting for the extra rainfall.

With the rain cranking up, so has the leaf disease in all crops. Most crops have had at least two applications of fungicides for disease such as sclerotinia in canola and Spot Type Net Blotch (STNB) in barley. Wheat powdery mildew has needed controlling in crops that did not have an in-furrow treatment at seeding.

Overall grain yield potential is well above average for all crops in the region.

Kwinana North East

The Kwinana North East is having another good year with most areas receiving in excess of 300mm of rain for the growing season to date, which should deliver above average grain yields barring significant frost and heat in the spring. The areas southeast, east and north of Merredin that were dry last year are a lot better this year and due to the large areas involved, could add considerably to the state’s tonnage.

There are greater subsoil moisture reserves in the region than this time in 2021 when the devastating frosts hit. The current levels of subsoil moisture improve the chances of some recovery should a percentage of the crop be taken out by frost. The current yield potential of crops is nowhere near that of last year, although the condition of the crop over a large area with good moisture reserves going into spring means the potential grain production could be well up on 2021.

Albany Zone

Albany West

The crops in the Albany West zone are better across the entire zone than last year, with much less waterlogging meaning the better areas of paddocks are not being relied on to do all the heavy lifting to compensate for the poor areas. The cool temperatures have slowed crop development down and allowed crops to bulk up more in recent weeks. The very advanced development of crops up until July has slowed right down to crops now being a bit behind where they would normally be for this time of the year. The majority of crops went in very early and this extended growing season will play a big part in the expected large tonnage estimated to be produced in the region.

Leaf diseases in wheat and barley have needed repeat fungicide applications, reflecting how good a year the region is experiencing. The mice have moved in and are now at thresholds where they will cause damage and have forced growers to compete for planes for their late crop protection applications.

Albany South

Other than ending up a little wet in August, the region is set for another very good year. Many are commenting that it could be better than last year as cereal tiller numbers are off the scale and the crops are very even across whole paddocks, rather than having wet spots everywhere as occurred in 2021, particularly in the southern coastal areas. The only damper is in the northern portions of the zone where the shallow duplex soils have become very wet and due to their advanced growth stages, crops will have little opportunity to recover.

Crops in the area are more advanced than normal due to the early start, however many will be more frost prone than is usually the case.

As per the rest of the state, it has been a good year for leaf diseases reflecting the good growing conditions, particularly in the second half of winter.

Albany East (Lakes Region)

Generally speaking, crops are very good in the region.

Wheat disease levels are low, and crops have handled the wet very well, much better than barley. Wheat’s place in the rotation sequence is also generally better than that of barley to have access to residual nitrogen (N). With the recent 15mm of rainfall over the weekend, and no extreme temperatures, one would expect well above average yields, perhaps in line with last year, but low protein levels are also expected.

Barley crops are getting sprayed late with fungicide for STNB, but otherwise yields will be well above average and perhaps similar to last year, as they are not as wet.

Canola crops are good, and many have been baited for mice, although some are only just getting done now due to the lack of access to planes. Most are still flowering, although generally flowering is winding down. Disease and insect levels at present are low.

The unknown at this point is the impact of the two days of frost which occurred last week. They were not bad frosts but one would expect some damage to have occurred on early crops in low lying areas. We are entering a higher risk period now as many barley crops are at head emergence/flowering, wheat crops are booting, and canola flowering is coming to an end so it will have limited ability to compensate in the coming weeks.

The forecast for the coming week looks good, fingers crossed.

Esperance Zone

Up until recently, crops in the zone have not been as good as in 2021, which was a record by a fair margin due to crops being even across the whole zone. However, since the August rains, things have turned around and now most areas have similar potential to 2021. Crops are shorter this year, although late tillers are making up ground lost in early July.

The continued rain in the spring has improved the potential of all crops in the previously dry patches northeast of Esperance, and in the low rainfall areas to the north. Soil water reserves are now good and will assist in pushing grain size, which is where most of the extra yield will come from.

Crops have evened up in growth stage and consequently will be vulnerable to frost at a similar time. This increased frost risk is the biggest concern for growers over the next three weeks. If crops get through largely unscathed, grain production for the region will easily meet current predictions.